In November, North Carolina voters will decide on an amendment to the state’s constitution that would place a 5.5 percent cap on corporate and personal income tax rates. Currently, the income tax rate is 5.75 percent and will decrease to 5.499 percent in 2017. The North Carolina Constitution provides that income tax rates “shall not in any case exceed ten percent.“

The proposed amendment is similar to one proposed in 2015, Senate Bill 607, the Taxpayer Bill of Rights, which called for a cap on income tax at 5 percent. That bill also created “a new limit on the growth of State spending in the annual budget.”

The current income tax cap proposal does not include a restriction on expenditures, but it does “require the legislature to put 2 percent of what it spends each year into an emergency fund.” The release of such funding would require approval from two-thirds of both the House and the Senate.

North Carolina has made great strides toward tax equality in previous years. It is one of eight states that use a flat tax to determine personal income tax rates. North Carolina’s flat tax system began in the 2014 tax year, when tax rates lowered to a “flat 5.8 percent.” It dropped to 5.75 percent in 2015.

Standard and Poor’s reported in 2014 “high, progressive income taxes contribute to revenue volatility.” Workers have the ability to relocate or change jobs when taxes on personal income are no longer affordable, so if states choose to enact tax policies that negatively impact workers, economic growth will likely be hampered and a decline in tax revenues could follow as a result.

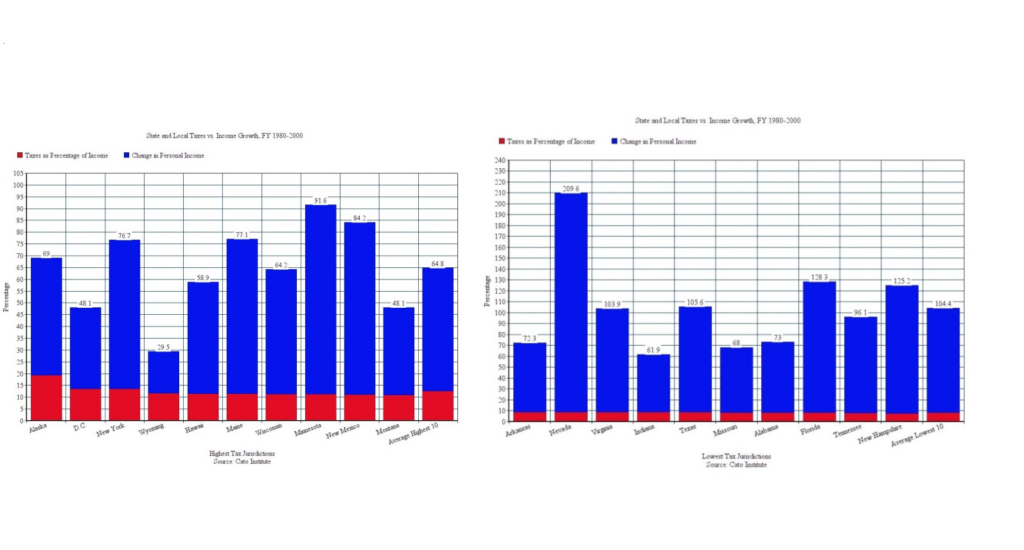

A 2003 Cato Institute study found from 1980 to 2000, “real personal income grew an average of 96 percent in the 10 states with the lowest state and local taxes as a percent of income,” as reported by The Heartland Institute’s Ten Principles of State Fiscal Policy. New Hampshire, which at the time of the study had the lowest state tax rate, experienced a 117 percent increase in real income. On average, real income increased by 100 percent in the 10 states with the lowest income tax rates States with the highest tax burdens saw income grow at an average of 52 percent.

States should reduce their reliance on personal income taxes and focus on responsible spending cuts and other reforms instead. If North Carolina caps personal income tax, it would take a positive step toward creating a better climate for businesses and a friendlier tax environment for residents.

The following documents offer additional information on state tax policy and reform efforts.

Ten Principles of State Fiscal Policy

http://heartland.org/policy-documents/ten-principles-state-fiscal-policy

The Heartland Institute provides policymakers and civic and business leaders a highly condensed, easy-to-read guide to state fiscal policy principles. The principles range from “Above all else: Keep taxes low” to “Protect state employees from politics.”

Effects of Income Tax Changes on Economic Growth

https://heartland.org/policy-documents/effects-income-tax-changes-economic-growth

William G. Gale of the Brookings Institution examines the effects of changes to individual income tax rates to long-term economic growth. Gale says tax rate cuts can encourage individuals to work, save, and innovate, but they need to be financed with immediate spending cuts to avoid creating or worsening budget deficits. Tax reforms should improve incentives, reduce existing distortionary subsidies, avoid windfall gains, and avoid deficit financing.

Rich States, Poor States

http://heartland.org/policy-documents/rich-states-poor-states-alec-laffer-state-economic-competitive-index

The fifth edition of this publication from the American Legislative Excha nge Council and authors Laffer, Moore, and Williams offers both individual-state and comparative accounts of the negative effects of income taxes.

Critics of North Carolina Tax Reform Miss the Point

http://taxfoundation.org/article/critics-north-carolina-tax-reform-miss-point

Elizabeth Malm of the Tax Foundation addresses some of the criticisms of the proposed tax reforms in North Carolina. Malm argues that although economic growth under the proposed plan won’t be instantaneous, a “continued, consistent commitment to a system that won’t discourage the very things that will move North Carolina’s economy forward will most definitely benefit the state in the long run.”

More Jobs, BIGGER Paychecks: A Pro-Growth Tax Reform for North Carolina

http://heartland.org/policy-documents/more-jobs-bigger-paychecks-pro-growth-tax-reform-north-carolina

The Civitas Institute examines North Carolina’s tax system and proposes a pro-growth tax reform plan, including income tax elimination. “Any tax reform in North Carolina should increase the after-tax income for the next dollar earned and raise the reward to work. Tax policies that increase the incentive to produce, invest and innovate attract industries and entrepreneurs. Increased economic growth, income and employment follow. Tax reform should reduce the penalty from additional work, savings, and investment and subsequently encourage increased work effort, increased wages, increased savings, and greater investments (and subsequently, greater capital accumulation),” the report states.

Tax Efficiency: Not All Taxes Are Created Equal

http://heartland.org/policy-documents/tax-efficiency-not-all-taxes-are-created-equal

Jason Clements, Niels Veldhuis, and Milagros Palacios identify the least-costly and least-economically damaging ways governments can extract tax revenues, strategies the authors say will improve economic performance.

Research & Commentary: State Income Tax Revenue Since the Fiscal Cliff

https://heartland.org/policy-documents/research-commentary-state-income-tax-revenue-fiscal-cliff

Matthew Glans, Senior Policy Analyst at The Heartland Institute, examines the impact of the reduction and/or elimination of state income taxes and the revenue states bring in. Glans notes the shortfalls that were expected in the immediate aftermath of such changes, but insists that “studies have shown states with no income tax or with lower income taxes perform better economically.”

States See Spring ‘Surge’ in Income Tax Revenues

http://taxfoundation.org/blog/states-see-spring-surge-income-tax-revenues

Joseph Henchman of the Tax Foundation examines the 2013 tax windfall that emerged due to the 2012 fiscal cliff. Henchman warns states against assuming the additional revenue was anything but a temporary increase: “All good news, right? So long as we understand that if [acceleration of capital gains realizations] is indeed the cause, much of the boost is temporary. One-time sales of capital gains are exactly that: one-time. The CBO report I just linked to unnerved me a bit because they show this spring’s tax revenues as an upward trend rather than a spike. States should be careful not to make that same assumption.”

The Historical Lessons of Lower Tax Rates

http://www.heritage.org/research/reports/2003/08/the-historical-lessons-of-lower-tax-rates

Daniel Mitchell of The Heritage Foundation examines the historical results of income tax cuts and finds a distinct pattern throughout American history: When tax rates are reduced, the economy’s economic growth rate improves and living standards increase.

Nothing in this Research & Commentary is intended to influence the passage of legislation, and it does not necessarily represent the views of The Heartland Institute. For further information on this subject, visit Budget & Tax News at https://heartland.org/publications-resources/newsletters/budget-tax-news, The Heartland Institute’s website at http://heartland.org, and PolicyBot, Heartland’s free online research database at www.policybot.org.

The Heartland Institute can send an expert to your state to testify or brief your caucus; host an event in your state; or send you further information on a topic. Please don’t hesitate to contact us if we can be of assistance! If you have any questions or comments, contact Nathan Makla, Heartland’s state government relations manager, at [email protected] or 312/377-4000.