Obamacare plans have reached the edge of a cliff. The U.S. government has shut down because Democrats and Republicans disagree on how much taxpayers should subsidize premiums.

Health care is a service, not an entitlement, so why should taxpayers have to support any of it, except for the neediest? Does the government help Americans pay for other costly items, such as a home purchase, rent, or tuition? Does it subsidize auto, life, or homeowner’s insurance?

“Insurance” is a contract between an individual or business to protect a person from financial loss due to an unexpected event such as an accident, illness, or natural disaster.

Taking care of one’s health throughout life is not “unexpected.” The idea that we need insurance to pay for routine health care is not because health events are “unexpected” but because health care today is cost-prohibitive to many people. We can thank government meddling for that.

High Government Control

The U.S. government controls 84 percent of the nation’s health spending, just behind the level of Cuba, writes Cato Institute health policy director Michael Cannon in National Affairs.

“In fact, government controls a larger share of health spending in the United States than in 27 out of 38 OECD-member nations, including the United Kingdom (83%) and Canada (73%), each of which has an explicitly socialized health-care system.”

Payment Plan Distortions

The Affordable Care Act (Obamacare) redefined insurance. In the Obamacare era, health insurance isn’t necessarily “risk mitigation” but a “payment plan” designed to pay for services most people in past years could afford to pay out of pocket.

In a direct-pay system, consumers continually determine the value of products or services. When a “payment plan” or other third party pays the bill, the consumer is abstracted from the cost. With costly health plans such as Obamacare, consumers say “yes” for reasons other than the value of the service, such as whether I am getting my money’s worth from the health insurance premium I pay each month.

When consumers utilize health insurance for services of questionable value to them, it drives up costs for everyone. Suddenly, there are not enough health professionals to service that artificial demand. The prices of diagnostics, imaging, pharmaceuticals, and other services all rise.

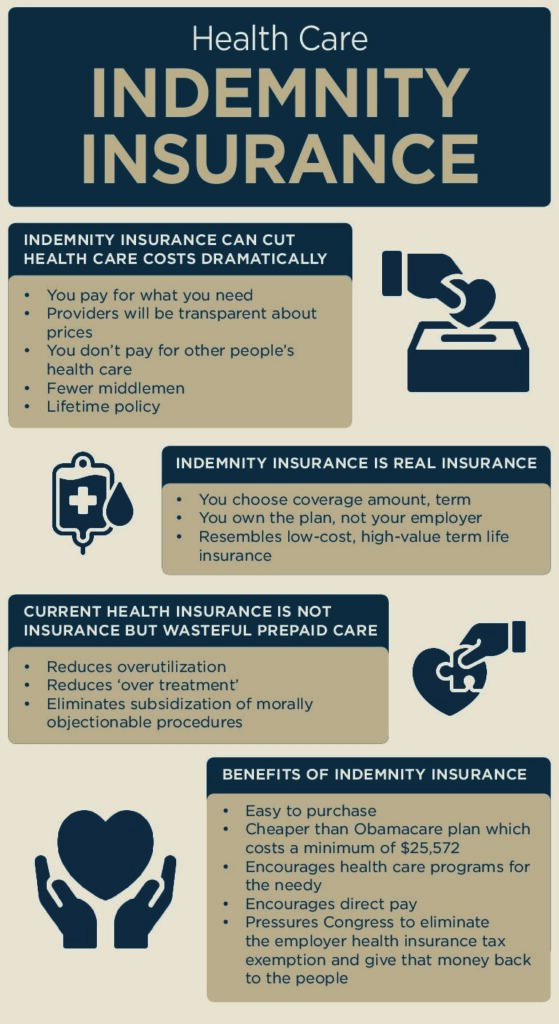

Indemnity Advantages

A graph on the Association of American Physicians and Surgeons (AAPS) website shows health insurance premiums increased by 297 percent from 2000 to 2024.

“True health insurance, which reimburses the subscriber—not the provider—according to the terms of the contract (as through an indemnity table), has practically vanished,” writes AAPS. “Such insurance covers only unpredictable catastrophic costs, not routine or known costs. It does not “manage” care, but just pays bills, like other casualty insurance. Premiums are based on risks, as calculated by actuaries.”

This is known as indemnity-style insurance. With indemnity insurance, consumers choose the coverage amount and length of term, similar to term life insurance policies, which are quite affordable when you buy them when relatively young.

Indemnity policies can address many of the health care complaints heard universally today, says Twila Brase, R.N., president and cofounder of the Citizens’ Council for Health Freedom.

“When there were indemnity plans, there was no quibbling, no prior authorization, no post-treatment denials of payment, no corporate protocols controlling physicians and medical decisions,” said Brase. “Many people forget what real health insurance is and how inexpensive it used to be.”

Paying Only for What’s Needed

With Obamacare having upended the health insurance market, it is nearly impossible to find an indemnity-style health insurance plan today. Many of those you might find are only “supplemental,” meaning you are required to have a health insurance plan to cover most of your health care bills.

Consumers can couple true indemnity plans and pay directly for primary care through the “direct primary care (DPC),” model, a low-cost, non-insurance membership service that provides unlimited primary care.

DPC works outside the third-party payment system, so providers can afford to sell the service for as little as $100 a month. Doctors and health care professionals in DPC can spend far more time with patients than the 15 minutes common today, and that attention helps patients avoid costly specialty services and hospitalization.

This arrangement may not work for the small percentage of people with significant disabilities. In that case, states could go back to the systems they had in place for that population before Obamacare went into effect: known as “insurers of last resort,” or “reinsurance,” which states funded in a variety ways, like a catastrophic claims program for auto insurance.

Insurance for a Lifetime

In today’s American health care system, we all “pay for other people’s health care.” This is why reform proposals such as Plan for America include indemnity-style health insurance: to end out-of-control entitlement spending.

Many of us get sick, old, or unlucky. Over a lifetime, such events happen infrequently. Insurance companies have to be solvent to keep offering coverage. It is almost impossible to provide affordable coverage when people can jump on plans only when they need them, which is what Obamacare allows.

I believe consumers would love to have lifetime coverage and buy it over a lifetime if the plan is affordable. Indemnity plans do that.

AnneMarie Schieber ([email protected]) is the managing editor of Health Care News.