John Rutledge

Dr. John Rutledge was one of the principal architects of the Reagan economic plan in 1980-81 and has been an adviser to the Bush White House on tax policy. Dr. Rutledge is the Chairman of Rutledge Capital, a private equity investment firm that has invested more than $150 million in middle market manufacturing, distribution, and service companies.

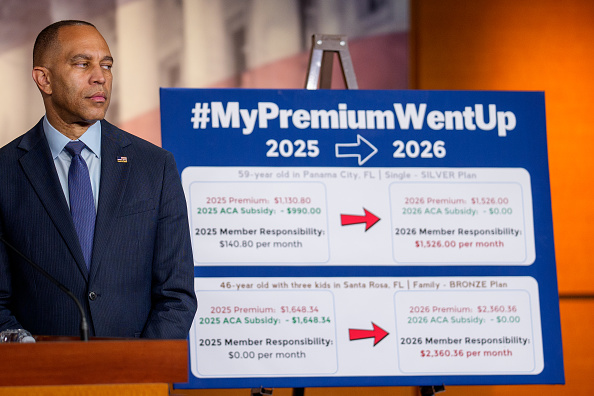

He is a member of the Advisory Boards of B.V. Group, a venture capital, hedge fund and real estate investment firm, and First Q Capital, a hedge fund. Dr. Rutledge is a visiting professor at the Chinese Academy of Sciences and Chief Advisor for Finance and Investment to the Governor of the Haidian District in Beijing. He is a board member of the Progress and Freedom Foundation, the Heartland Institute, and a senior fellow at the Pacific Research Institute.

Dr. Rutledge has an active lecture practice, giving talks on global economics, capital flows, financial markets, investment strategies, the impact of technology on the economy, and strategies for owning and growing the value of a business. After tours of duty in both academics and government policy, he has started, run, chaired, owned and harvested dozens of companies, and has managed real money in both mutual funds and private equity.

Dr. Rutledge first introduced his Asset Market Shift framework for analyzing capital markets in the Wall Street Journal in the 1980s. Initially controversial, the framework, in which interest rates and other asset prices are determined by private arbitrage behavior, applies a rigorous foundation from thermodynamics to portfolio management. Dr. Rutledge uses the framework to track asset market shifts and develop strategies that attract capital and build wealth, bridging the gap between macroeconomic analysis and portfolio management.

Over the past twenty years, he has used this framework on economic analysis, asset allocation, portfolio selection, business strategy, restructuring, acquisitions and divestitures. Dr. Rutledge advises institutional and individual investors how to structure portfolios to take advantage of opportunities created by a temporary divergence of prices from Intrinsic Value. His many advisory and speaking clients include governments, corporations, and financial institutions around the world.

When not traveling the globe, Dr. Rutledge appears weekly on Fox News’ Saturday morning business shows Forbes on Fox andYour Questions, Your Money Live. He is a frequent guest on CNBC’s Kudlow & Company, PBS’ Wall Street Week with Fortune, and CNN’s In the Money. Dr. Rutledge wrote the Business Strategy column for Forbes for more than a decade and writes for Forbes.com and TheStreet.com. He also authors the acclaimed Rutledge Blog on economic and technology issues atwww.rutledgeblog.com.

Dr. Rutledge is the author of the 2007 U.S. Chamber of Commerce study on the economic impact of the proposed carried interest tax and one of the principal authors of the 2005 U.S. Chamber of Commerce study on telecom reform. He has also written three books-Rust to Riches, A Monetarist Model of Inflationary Expectations, and Lessons from a Road Warrior-and hundreds of articles for the Wall Street Journal, the American Spectator, China Weekly, Barron’s, Forbes, Fortune, the National Review, the Financial Times, U.S. News and World Report, Business Week, and other publications. He testifies frequently before Congressional Committees and has advised government officials in the United States, United Kingdom, Ireland, China, and Kuwait.

Dr. Rutledge began his career as a professor of monetary economics, international finance and econometrics at Tulane University and Claremont McKenna College. In 1978, Dr. Rutledge founded the Claremont Economics Institute, an economic advisory business in Claremont, California. He holds a BA from Lake Forest College and a PhD from the University of Virginia. He divides his time between Las Vegas, New York, Newport Beach, Maui, and Beijing.