Life, Liberty, Property #117: Fed Interest Rate Cut Remains on the Table

Forward this issue to your friends and urge them to subscribe.

Read all Life, Liberty, Property articles here, and full issues here and here.

IN THIS ISSUE:

- Fed Interest Rate Cut Remains on the Table

- Video of the Week: A Political Assassination in Utah: RIP, Charlie Kirk – In the Tank Podcast #510

- BLS Numbers Racket Exposed

- Lower-Court Defiance and Its Likely Consequences

- A Solution for High Prescription Drug Prices

- Cartoon

Fed Interest Rate Cut Remains on the Table

All signs now point toward the Federal Reserve (Fed) beginning a program of lowering interest rates, though cautiously and with no guarantees of continuation. A program of steady cuts would remove an important impediment to investment in U.S. economic concerns.

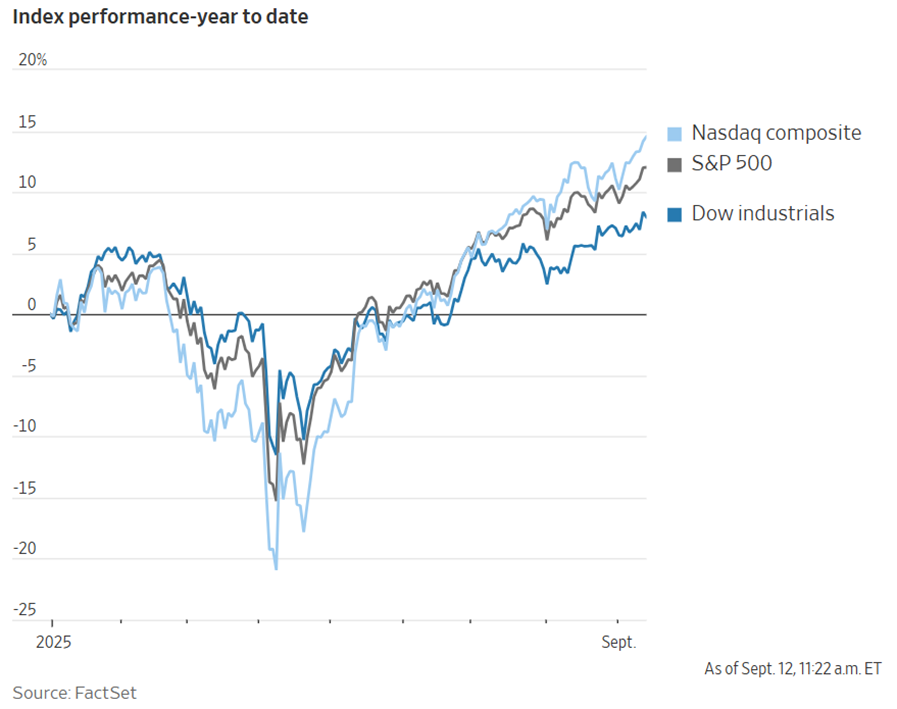

Last week’s government reports showed a rise in price inflation. The stock markets rose sharply throughout the week, however, reaching new record highs:

Source: The Wall Street Journal

Investors and analysts believe the Fed will lower the federal funds rate on Wednesday by 25 basis points (0.25 percent) or possibly even 50, though the latter now looks much less likely given the inflation numbers.

Trading Economics reports:

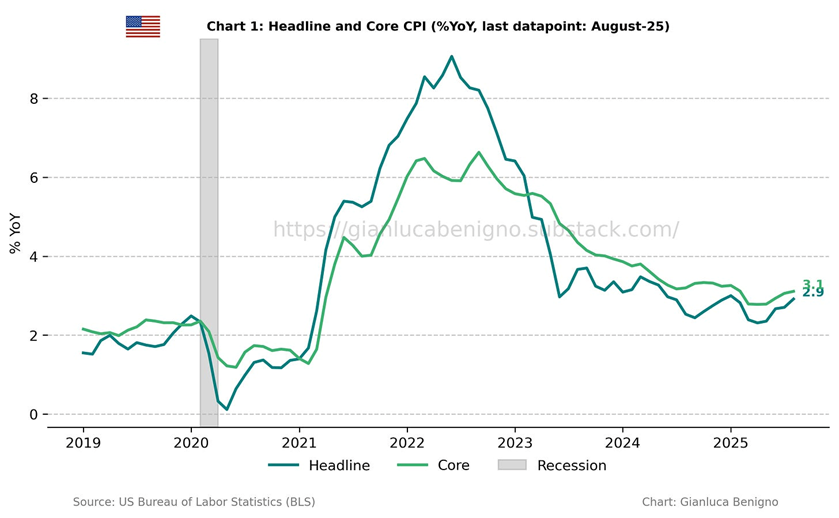

The US annual inflation rate accelerated to 2.9% in August 2025, the highest since January, after holding at 2.7% in both June and July, in line with market expectations. Prices rose at a faster pace for food (3.2% vs 2.9% in July), used cars and trucks (6% vs 4.8%), and new vehicles (0.7% vs 0.4%). Also, energy cost increased for the first time in seven months (0.2% vs -1.6%). …

On a monthly basis, the CPI went up 0.4%, the most since January, above forecasts of 0.3%. Shelter rose 0.4% and made the largest upward pressure. On the other hand, core inflation remained steady at 3.1%, the same as in July and at February’s peak, while core CPI rose 0.3% month-on-month, matching July’s pace and market forecasts. source: U.S. Bureau of Labor Statistics

With employment stagnant and unemployment rising slowly, the Fed should be satisfied that interest rates have been high enough for long enough to suit the institution’s belief in the Phillips Curve, which holds that low unemployment raises prices by creating excess demand for workers. (In reality, low unemployment simply reflects demand for workers, and such demand is a good thing because it indicates production of goods and services is increasing, unless government hiring is increasingly rapidly, which is not the case at present.)

The inflation numbers, however, are giving many analysts—especially those who adhere to conventional wisdom—a reason to caution that the money supply is too big.

Context is crucial to understanding those inflation numbers. Even with the uptick in August, inflation is at last year’s average, when the Fed lowered interest rates by 100 basis points (a full percentage point) starting two months before the November election. (No politics involved in that decision, of course….):

Source: The Central Banks’ Watcher

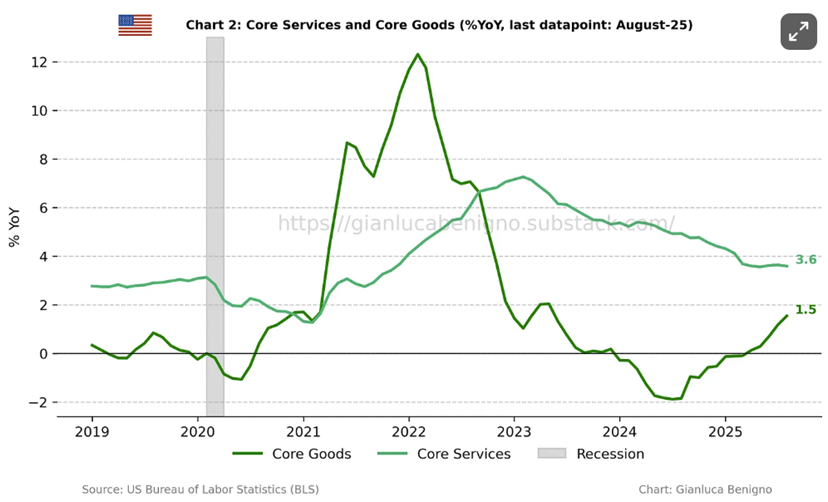

At 1.5 percent, core goods inflation is up from earlier in the year but still below the Fed’s overall target of 2 percent. Core services inflation remains high, at 3.6 percent, though it has been trending down since its 2023 peak:

Source: The Central Banks’ Watcher

Wholesale service costs decreased, however, InvestorPlace reports:

Looking further into the report, wholesale service costs declined 0.2%, so that was a very nice surprise. Goods prices, excluding food and energy, rose 0.3%. The only glitch in the report was something called “trade services,” and that spiked 1.7%. But that’s a new indicator, and it’s very controversial, so I recommend we just ignore that for now.

Overall wholesale inflation continued to fall, InvestorPlace notes:

Yesterday’s PPI report showed a drop in wholesale inflation, falling 0.1% in August. Additionally, July was revised down to a 0.7% increase (it was 0.9% earlier). I want to remind you that the July increase was all due to wholesale diesel costs.

Producer prices are running below the Consumer Price Index, the same source observes:

In the past 12 months, the PPI is now running at a 2.6% annual pace. That was substantially below economists’ expectations of a 3.3% increase. Also, the PPI has been negative in three of the past six months.

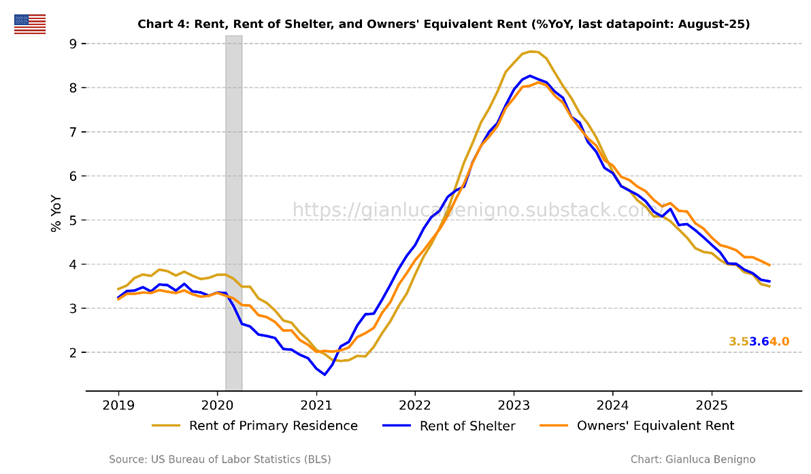

Owners’ Equivalent Rent (OER) is still high, artificially skewing the Consumer Price Index higher—no one pays (OER), and hence it should be excluded from inflation considerations (which would indicate that true inflation is lower than the PPI suggests):

Source: The Central Banks’ Watcher

As the New York Post reported, “Thursday’s CPI data showed the index for shelter rose 0.4% in August from the previous month, and was the largest factor in the overall monthly increase, according to the Labor Department. It’s up 3.6% over the past 12 months.”

In addition, inflation was unusually low in August 2024, which skews the year-over-year number higher than those of previous months. The 2.9 percent YoY number is thus anomalous and does not justify major concern.

All of this suggests that inflation did not heat up in August and remains at or below last year’s rate, suggesting that the Fed should go ahead and start cutting the fed funds rate slowly and judiciously, just as it did last year with an election on the way, before the economy starts to slow down significantly. (I think the Fed should continue to shrink its balance sheet—aka quantitative tightening—by not replacing expired Treasury and mortgage bonds, as it has been doing for a couple of years now.)

It may in fact be too late for the Fed to avert a recession. That is the Fed’s usual course: doing too much, too late, and for too long. However, waiting for a recession to begin before reversing course on interest rates would make the situation even worse.

As to the public-policy implications of all this, they remain the same as ever: the federal government should cut spending and reduce tax rates, with spending cuts as the higher priority. The House Freedom Caucus is recommending a spending freeze that would maintain federal outlays at fiscal year 2024 levels—keeping the (appalling) Biden spending levels in place. That would be better than no spending reform at all, and a spending freeze amounts to a spending cut in real terms as economic growth increases the nation’s production of goods and services.

Even Freedom Caucus stalwart and budget hawk Rep. Chip Roy endorses a freeze:

Rep. Chip Roy, R-Texas, told The Daily Signal he’d “totally be great with a one-year freeze in spending for a year. That’s a victory for the American people every day and twice on Sunday.”

He explained that the caucus would not look kindly on any overall spending increase coming out of the annual funding process.

“The Freedom Caucus position is: Under no circumstances can spending be greater than current-level spending. It must be flat or go down,” Roy said, adding that the caucus would trust the White House to add spending cuts on top of this CR due to its work “shutting down and removing bureaucrats.”

Roy added, “at the end of the day, if you’re holding spending frozen while you go grow the economy, you’re winning, because you have a president who’s willing to go take on the Swamp. Now I’d love to pass appropriations bills with massive cuts, but we got to get it through a Senate with Democrats, and you’ve got to get 60 votes in the Senate.”

Given the impossibility of getting real spending cuts through Congress, I endorse the freeze too.

Sources: Trading Economics; The Central Banks’ Watcher; InvestorPlace; New York Post; The Daily Signal

Video of the Week

Unspeakable horror struck on the campus of Utah Valley University in Orem, Utah. Charlie Kirk, the founder of TurningPoint USA, was murdered by an assassin’s rifle shot while he was speaking to a crowd of thousands. Charlie’s talent, credibility, intelligence, authenticity, patience, and courage were on display for all to see to the very end of his life. He was a champion of liberty and a tireless patriot whose love of country was deep and heart-felt. More than that, Charlie was a devoted Christian and a loving father and husband. At the age of just 31, he left a legacy greater than many public figures twice his age.

The assassination of Charlie Kirk was an act of evil. It was also undoubtedly a political act spawned out of the dark heart of modern leftism. We live in a country in which prominent media outlets suggested Charlie brought his public slaying upon himself. In today’s media and political environment, anyone who vigorously differs from leftist ideology and Democratic Party talking points is painted as a fascist, a threat to democracy, a domestic terrorist — or, as President Biden once put it — a threat to “the very soul of this nation.” This is the political environment in which the killing of Charlie Kirk occurred.

BLS Numbers Racket Exposed

Regular readers of this newsletter and my op-eds in other publications are probably familiar with my criticisms of federal agencies’ reports of economic numbers, which became increasingly dubious during the Biden administration. President Donald Trump picked up that theme upon returning to the Oval Office earlier this year, and the discrepancies have gotten even worse, with the Bureau of Labor Statistics (BLS) making a highly embarrassing admission last week.

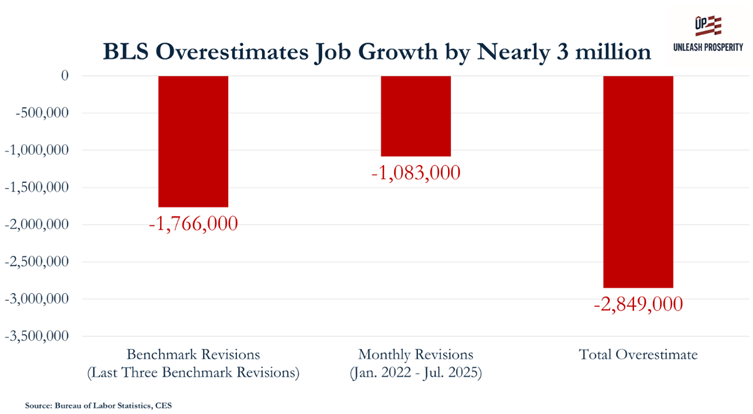

The U.S. economy added only half as many jobs as the BLS had initially reported for the year leading up to this March, the biggest downward revision in history. The economy created 911,000 fewer jobs than the BLS reported during this critical period, which included a presidential election, with the continual large errors by the BLS just happening to make the incumbent president’s performance look far less awful than it really was.

The estimated job additions for the period in question averaged 147,000, of which 76,000 per month were fictional—more than half the reported total.

The overestimate of job growth since January 2022 was 2.8 million, the Unleash Prosperity Hotline reports:

The revisions show that the economy the Biden administration handed off to President Trump was in far worse shape than the false official numbers indicated, which had the political effect of creating higher expectations for the incoming administration than were justified, Heritage Foundation Acting Director of Economic Policy Studies Richard Stern told The Daily Signal:

“Notably, 10 of the 12 months encompassed by massive errors in this report fall under the Biden administration, casting a stark spotlight on the economic challenges and persistent headwinds inherited from the previous administration’s policies, which have profoundly impacted hardworking Americans,” Stern [said].

Government economic data influence government policy and affect a multitude of daily decisions by individuals and businesses. The numbers also have major political effects. The corruption of official data demonstrated by the BLS revision could have contributed to a change in last November’s election results. Perhaps they did, in House, Senate, and state races and in Trump’s victory margin. Since then, political effects have arisen from the inaccurate comparison between current economic performance and the false picture of last year’s economy that the government agencies promulgated.

This is a major scandal, and the BLS requires thorough reform.

Trump began that process by firing Commissioner Erika McEntarfer last month. “Sure seems like firing the commissioner was warranted,” tweeted Heritage Foundation Media and Public Relations Director Cody Sergeant. That is one assessment that will not be revised downward.

Sources: The Daily Signal; Hotline

NEW Heartland Policy Study

‘The CSDDD is the greatest threat to America’s sovereignty since the fall of the Soviet Union.’

Lower-Court Defiance and Its Likely Consequences

The nation’s courts are in the throes of a “judicial insubordination crisis,” with lower-court judges increasingly defying Supreme Court precedents and openly criticizing the justices on the nation’s highest court, write appellate and constitutional lawyers Elizabeth Price Foley and Mark Pinkert in The Wall Street Journal.

The Supreme Court has brought on some of this defiance by issuing ambiguous decisions and establishing conflicting precedents, the lawyers write. However, lower court judges are clearly “flooding the zone” to overwhelm the Court and delay and confuse implementation of Trump administration initiatives. The Supreme Court has responded by increasing the number of emergency decisions it issues, which the inferior courts evade by pretending they do not understand the Court’s intentions:

[S]ome district judges have issued vague and sweeping decisions that grant injunctive relief to stop the executive branch from acting. These decisions, in turn, force the Supreme Court to issue emergency orders more frequently. Such orders are handed down quickly, without full briefing or argument. Lower courts then lament that the orders are unclear, which results in flawed rulings that lead to more emergency orders from the justices. So far this year, the high court has issued 20 emergency orders, revealing a significant disconnect between the justices and some lower-court judges.

I say that it is a good deal more than a disconnect. It is open defiance and emphatic mockery of the high court’s authority. The attorneys accurately describe this as “a much more troubling trend,” writing,

Some lower federal judges are acting as if their job is to resist the Trump administration’s agenda rather than follow Supreme Court precedent. They overtly express disagreement with the court, then use clever tactics to evade the high court’s directions. Sometimes they employ a hyper-narrow construction of the court’s rulings. Other times they make dubious factual determinations, knowing that appellate courts will give them deference. The subterfuge creates a serious challenge for the justices, since they don’t have the capacity to review every misapplication of their precedent.

This emboldens some lower-court judges to push the boundaries, and the intrajudiciary tension has reached a fever pitch recently.

Supreme Court justices are explicitly admonishing lower courts not to “defy” their decisions and are begging them to “respect the hierarchy of the federal court system created by the Constitution and Congress,” the authors observe. Judges on the inferior courts are ignoring those pleas and are even criticizing the Supreme Court in their official dicta and in the press.

The Constitution does not grant the Supreme Court direct authority to manage or fire lower-court judges. That authority belongs to Congress, and there is no chance that the current ideologically divided legislature will clean up the lower courts: “Legislation to reorganize or otherwise alter the lower courts would need to overcome the Senate’s 60-vote filibuster threshold, and impeaching a defiant judge requires a two-thirds Senate vote for conviction,” the attorneys note.

Foley and Pinkert call on the Supreme Court to “provide doctrinal clarity, especially on constitutional law.” That is indeed the Court’s responsibility. However, lower courts are evading and openly defying very clear precedents the Court has set. That is simple malfeasance and cannot be tolerated.

It may seem that we are just going to have to live with this flagrant defiance of Supreme Court authority over the lower courts and these inferior-court judges’ unconstitutional obstruction of the Executive Branch of the federal government.

Well, maybe not.

These rogue judges are inviting responses that they could come to regret. The Supreme Court majority could become sufficiently frustrated that it begins issuing decisions that are much more sweeping, straightforward, and restrictive of the lower courts’ discretion than the often-wishy-washy, overly fastidious precedents it has laid down in recent years. If the inferior courts are taking advantage of every little bit of wiggle room, the highest court might well decide it has no choice but to put them in straitjackets.

I would not be at all surprised if the Court were to move in that direction, which is what Foley and Pinkert suggest they do, though less forcefully than I am putting it.

The lower courts may, however, simply defy even those very clear directives from the Supreme Court. Should that happen, President Trump would have every right to nullify those decisions in accord with his oath to “preserve, protect, and defend the Constitution.” It is quite possible that the Supreme Court majority would back the president on at least some such decisions. Lower courts usurping the functions of all three branches of the federal government would make themselves the enemies of the entire government, the Constitution, and the people of the United States.

Obviously, that would be a foolish thing for those judges to do. The rulings that the most-deviant lower-court judges have issued already this year, however, amply indicate that they are fully capable of such folly.

Source: The Wall Street Journal

A Solution for High Prescription Drug Prices

High and rising prescription drug prices have long been a major political issue, with politicians and analysts on both sides of the political aisle pushing further government intervention as the solution.

The proposed solutions consistently fail to work as advertised, raising prices even more and bringing on calls for still-greater intervention and regulation. That happens because the government’s policies try to push prices down directly instead of creating a market environment that will control prices without coercion, write David R. Henderson, Charles L. Hooper, and Solomon S. Steiner at Law & Liberty.

“The proposed solutions almost always focus on the final step in the drug development and marketing process: the sale of the drugs to various government payers,” the authors write. The high costs, however, originate much earlier in the process, and government regulation is the cause:

Before 1962, developing a new drug took just two years; it now takes 12 to 14 years. Since 1975, capitalized drug development and approval costs have increased at 7.5% per year in real terms, doubling every 10 years. Given this growth rate, we estimate that drug development costs are now, on average, nine billion dollars per successful new drug.

Why does the process take so much longer and cost so much more? Because, since 1962, drug companies have needed to prove, to the Food and Drug Administration’s satisfaction, that new drugs are safe and effective for a particular disease or condition. Between 1938 and 1962, drug companies were required to prove safety, but not efficacy. With our proposal, the safety requirement would still stand. Safety, after all, is the most important aspect of any drug, given that all past drug tragedies have been about safety, not efficacy. The proof of efficacy requirement—where most drug development costs, risks, and time are incurred—provides little value for patients and doctors.

Government has a valid case for requiring companies to prove that their drugs are not poisonous (although an honest tort system governed by common law could probably do so while introducing far fewer efficiencies). It harms patients and raises prices, however, for the federal government to require proof of efficacy before granting marketing approval. Doctors and patients can determine efficacy for each individual without interference from the Food and Drug Administration. In addition, companies would be able to make many more pharmaceuticals available for people to choose from at much lower prices, the authors write:

A clinical trial might show that a new drug provides therapeutic benefits to 60% of patients. And yet we will never know, before a patient has actually tried the new drug, whether he will be in the 60% group or the 40% group. The FDA doesn’t know. The treating physician doesn’t know. And the patient doesn’t know. Whether the FDA requires proof of efficacy before approval has no effect on whether the patient and doctor must rely on trial and error to find the right pharmaceutical at the right dose. This necessarily means that the FDA is wasting tremendous resources by requiring drug companies to prove efficacy before receiving marketing approval. Why? Because all that time, money, and energy provides little value to doctors and patients who still won’t know, even after “proof of efficacy” is established and the FDA authorizes marketing approval, whether the new drug will work for them or not.

Having more treatment options is obviously better for patients, the authors write:

An understanding of the practice of medicine allows us to see that doctors need more than one therapeutic option because not all drugs work for all patients. How many therapeutic alternatives? The more the better. Doctors can’t know a priori which medicine will work for which patient, and so they rely on the ancient practice of trial and error.

… When the FDA rejects a new drug application because the demonstrated efficacy is less than what the FDA considers “enough” for approval, it takes away a legitimate therapy option for patients. Even if the new drug is effective in only 30% of patients, less than the 60% for the existing therapy, the new drug might be effective in a substantial fraction of the 40% of patients who weren’t helped with the current drug.

The authors’ proposal would lower drug prices, they write:

First, it would dramatically decrease the costs, timelines, and risk of developing novel drugs. That means that drug companies would face a lower threshold for drug development. This would increase the number of new drugs developed and reduce the revenues required for each drug to break even financially. Lower revenues required for breakeven mean that lower prices could be offered.

Second, the increased competition that necessarily comes from additional competitors has historically been the best way to keep drug prices low. Every new drug must have a value proposition—a reason to justify its purchase—or else customers will see no reason to purchase it.

Drug companies would choose to study proposed drugs’ efficacy, the authors write, to ensure that their products will have a market because they work. That adds value to the drug marketplace, whereas conducting multiple tests over a lengthy period of time to satisfy government bureaucrats is extremely expensive and prevents useful drugs from going to market so that people can be healed and have relief from pain and discomfort.

The evidence shows that “requiring proof of efficacy before approval is unnecessary and wasteful,” the authors conclude. “It provides some additional information, but the information is expensive, and it doesn’t eliminate the necessity for trial and error.”

The law of supply and demand applies to drugs as to anything else. “The answer to high drug prices is more drugs,” the authors write.

Source: Law & Liberty

Contact Us

The Heartland Institute

1933 North Meacham Road, Suite 559

Schaumburg, IL 60173

p: 312/377-4000

f: 312/277-4122

e: [email protected]

Website: Heartland.org