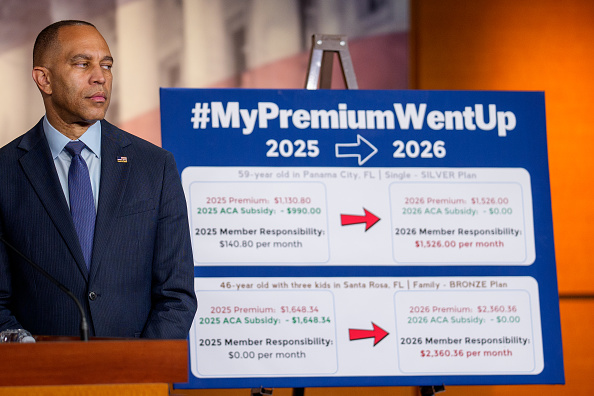

Democrats in Congress have been desperately trying to keep Obamacare on life support. A recent scare tactic is from the Kaiser Family Foundation (KFF), which estimates Obamacare premiums will rise 114 percent without extending the so-called enhanced subsidies.

“In 2021, the American Rescue Plan Act, a pandemic relief law, temporarily increased the amount of the premium tax credit and expanded eligibility to households with an annual income of more than 400% of the federal poverty limit. (This includes a family of four with income of more than $128,600 in 2025, for example.),” CNBC stated on October 17.

One would have to dig deeper into the fine print to see what scenario KFF is referring to. Averages mean almost nothing: the subsidies and premiums vary with age, income, region, and the type of plan purchased.

In years before the enhanced subsidies, only the poor (who got generous subsidies) and the sick found Obamacare to be a fair value. The middle class and upper middle class largely opted out of Obamacare because of the prohibitive cost and low value.

An Intentionally Bad Deal

Obamacare is a bad deal regardless of who is paying the tab. And taxpayers subsidizing a bad deal to make it affordable distorts the market further and delays needed reform. The reality is, ACA Marketplace plans are beneficial for less than 10% of those who have them.

The left-leaning Commonwealth Fund calculated that about 90 percent of those with Obamacare plans do not surpass their deductibles. That suggests they would be no worse off financially if they were uninsured rather than enrolled in Obamacare.

In 2019, before COVID, just under one-quarter of enrollees (23 percent) did not file a claim during the plan year. After enhanced subsidies came into effect, that proportion increased to more than one-third (35 percent).

Obamacare was purposely designed to be a bad deal for most people. By most, I mean a bad deal for more than eight of ten customers. In health care there is what is known as the 80/20 rule. That is, 80 percent of costs are accrued by the sickest 20 percent of enrollees.

People purchase insurance in case they land among the unlucky 20 percent. Actuaries claim the sickest 20 percent are not the same every year but sometimes they are. That is the whole point of Obamacare: to force me to overpay every year by $5,000 to $7,000 so the sickest 5 percent of people my age can get coverage for the same price as me.

My (Bad) Experience

I had Obamacare for 2.3 years: 2022, 2023, and part of 2024. The combined premiums totaled nearly $20,000, of which Uncle Sam paid roughly $5,500. My out-of-pocket premiums were about $14,000.

During this 28-month period, I did not file a single claim. My first year, the insurance company’s provider network was so bad the state of Texas asked the company not to participate in the Texas Marketplace the following year. I consulted with physicians a time or two, but none were in my network. I received some health care—a prescription and comprehensive blood tests each of those years—but I paid for it all out of pocket.

I know what you’re thinking: insurance is best when you do not have to use it. That is true, and I do not worry that I am not getting my money’s worth out of my auto, motorcycle, umbrella, and homeowner’s insurance if I do not suffer a loss. The difference between my other insurance products and Obamacare is that all the other policies’ combined cost is about half what an ACA plan will cost me next year.

Double the Cost

It is hard to estimate, but a poor-quality health plan with 40 percent cost-sharing and deductibles of $8,000 to $9,000 for 28 months would probably cost no more than $4,000 if not for Obamacare regulations.

In round numbers, I threw $10,000 down an Obamacare rathole (and the government flushed an additional $5,500 on my behalf). That amounted to a $10,000 tax on my health that would have been better spent being added to my health savings account for future medical care.

Where did that $10,000 go?

Undoubtedly, it went to pad the health insurance company’s profit margin. Health insurers would argue it was used to pay for someone else’s medical care. Perhaps it went to pay for another patient’s $2 million drug. However, the reason $2 million drugs exist is because Obamacare banned annual and lifetime caps on benefits.

When 90 percent of customers are no worse off without your overpriced product, it is time to go back to the drawing board and design a better product. Let the enhanced subsidies expire. Without any subsidies, Obamacare would collapse under its own weight.

Devon Herrick ([email protected]) is a health-care economist and policy advisor to The Heartland Institute. A version of this article appeared on the Goodman Institute Health Blog. Reprinted with permission.