The failure of Illinois’ legislators to pass a pension bill in June was actually good news. The proposals that were on the table would have preserved Illinois’ flawed pension system without addressing its core problems.

The bills fell far short of giving Illinois’ public sector employees and taxpayers what they deserve – financial security and a prosperous state.

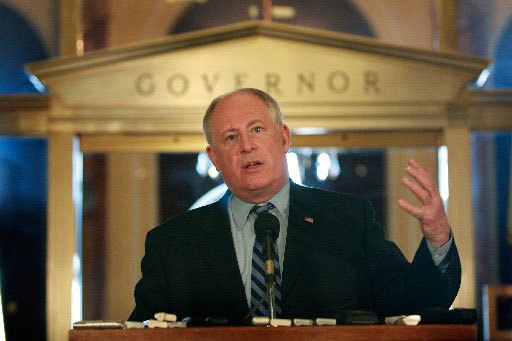

Unfortunately, what’s to be discussed during Gov. Pat Quinn’s (D) August 17 special session is no better. HB 1447 lacks real change and it’s been watered down to insignificance. At most it would reduce little more than 3 percent of the state’s total unfunded liability.

Some may say something, anything, is better than nothing at this crucial moment. We wish that were true, but when the ship is taking on water faster than this bill would bail out, there is only one outcome.

Principle Imperatives

If legislators truly want to reform pensions, they’ll need guiding principles to inform their proposals. Any new reforms should include the following principles:

- Shift control of pensions away from politicians and to public employees. Public employees deserve to be in command of their retirements;

- Protect taxpayers from the burden of pension shortfalls and missed investment targets;

- Eliminate or massively reduce unfunded liabilities for both pensions and retiree health care; and,

- Provide budget transparency and sustainability that Illinois needs in order to jump-start its economy and create jobs.

The bill set to be discussed on August 17 does none of the above.

Ignoring 75% of Problem

To begin, it excludes changes to both the Teachers’ Retirement System and the State University Retirements System, which make up nearly 75 percent of the state’s pension problem. Reform can’t be achieved when so much is off the negotiation table.

The bill also preserves the failed defined benefit system. The only way to get politicians out of the pension business is to move to a defined contribution system. State workers and retirees would then have full control and ownership over their retirements. Taxpayers would no longer be on the hook for the failures of legislators. Illinois can’t reform its pensions without a system heavily reliant on a defined contribution system.

Reforms must also address the state’s ballooning retiree health care liabilities. It’s widely known the state’s pension system has a massive shortfall, but state retiree health care obligations are another $54 billion. Both are ticking time bombs and both must be defused.

Yet instead of tackling both, the plan lets participants retain their right to retiree health-care benefits as a “consideration” for accepting lower pension benefits. Illinois can’t afford to sacrifice health care retiree reforms in order to get pension savings. The state must fundamentally reform both compensation benefits – not just one.

Sadly, HB 1447 would keep Illinois trapped in its economic death spiral.

Fiscal Medicine

How can Illinois get out of its pension mess? The following solutions tackle the problems head-on:

Reform retiree health care immediately. Don’t tie these reforms to any other action. Health care benefits are not questioned constitutionally and can be reformed. The Illinois Policy Institute has released a solution that reduces the state’s $54 billion unfunded obligation by more than half, while making sure to protect those state retirees with limited financial means.

Freeze pensionable salaries. This will immediately stunt the growth in pension liabilities and lay the foundation for fundamental pension reform.

Introduce 401(k)s. With the leverage gained by freezing pensionable salaries, the legislature can offer a viable and affordable 401(k) as “consideration” to all government employees. Without a defined contribution plan, there is no true reform. The defined benefit structure has enabled Illinois’ pension crisis and it must be eliminated.

Demand local pension accountability by moving yearly pension costs from the state to local school districts. We must end the practice of having one unit of government dole out pension sweeteners and salary spikes while another picks up the tab. That’s precisely the kind of governance that has bred failure in Illinois.

Illinois needs a real and sustainable plan to reform retiree benefits. It must end, once and for all, this pension debacle. Legislators should start anew. They’d be wise to follow these guiding principles. If they do, then government workers, current retirees and taxpayers alike will all be winners.

Ted Dabrowski ([email protected]) is vice president of policy at the Illinois Policy Institute.