Haircuts, booze, health club memberships, downloaded books, clothing over $100, auto repairs, dating services, lawyer bills, consultants, cigarettes, Rover’s checkups, tattoos — you name it.

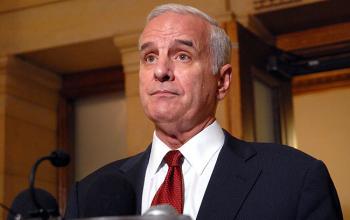

It’s the laundry list of services targeted for new taxes that defines Minnesota Gov. Mark Dayton’s $38 billion budget plan, which he hopes wipes out a projected $1.1 billion deficit, jacks up education funding by $1.1 billion, and distributes a $500 rebate to homeowners.

As the Democratic-Farmer-Labor Party candidate for governor, Dayton opposed expanding the sales tax as unfair to the middle class. Today he views tax reform as a legacy.

“We cannot afford not to invest. Minnesota’s future success depends up on it,” Dayton says now.

Broader Base, New Business Taxes

The sales tax rate would drop from 6.875 to 5.5 percent, moving Minnesota from seventh- to 27th-highest among the states. At the same time, the proposal calls for a revenue-neutral broadening of the base of goods and services subject to sales tax, increasing income taxes on the wealthiest income earners by $1.1 billion, and imposing business-to-business (B2B) taxes to raise $2.2 billion in additional new revenue.

“By broadening the base and lowering the rate, Governor Dayton’s budget makes our tax system fairer, modern and sustainable. It helps put Main Street businesses on equal footing with online retailers and aligns our sales tax rate with neighboring states,” the Minnesota Department of Revenue reported.

Dayton has received little credit for proposing to reduce Minnesota’s corporate tax rate from 9.8 to 8.4 percent, while drawing heavy flak for his B2B tax grab from the expected interest groups. It’s a “horrible idea” to the Minnesota Chamber of Commerce, a “misery tax” to the Minnesota Bar Association, a “hidden tax” to the Minnesota Jobs Coalition, and a “job killer” to the Minnesota Business Partnership. One agency branded it the “StupidTAX”.

News Media in Crosshairs

Perhaps most telling, one of the state’s most consistent editorial voices in support of tax increases of all stripes, the Star Tribune newspaper, has become a leading opponent of the B2B taxes. Publisher Mike Klingensmith told a local media outlet the proposal is “jaw-dropping” and would decimate the newspaper’s profits by up to 40 percent.

Minnesota’s largest circulation daily, the Star Tribune also took the unusual step of suspending contract talks with journalists who have gone without a raise for years, pending further analysis of the governor’s plan.

Dayton’s proposed sales tax on newspaper subscriptions, advertising and publishing services has sensitized others in the print media in particular to the dangers higher taxes may pose to an industry already fighting for survival. Media representatives are lining up to testify against the proposal in legislative hearings.

The Minnesota Newspaper Association has formed a coalition of broadcasters, advertisers and publishers in protesting the tax.

“Those changes would have an immediate, severe, and in some cases, devastating impact on virtually all of the state’s communications businesses, to the many thousands of employees who work in them, and to Minnesota’s economy more generally,” the group said in a statement.

‘Could Be Taxed Three Times’

“We could see the printing at the plant be taxed, the advertising that’s printed in the newspaper be taxed, and the newspaper be taxed. So before it gets to the subscriber it could be taxed three times,” Reed Anfinson, publisher of the Swift County Monitor-News Record, told Dayton at the Minnesota Newspaper Association’s annual conference.

“When you tax something, you get less of it,” Tom West, general manager and managing editor of the Morrison County Record, said at the same meeting. “We are the ones who cover local government and state government, and we are wondering why you would think it would be a good idea to have less information about government and what government is up to.”

The concept of a First Amendment sales exemption didn’t go far when a reporter pressed Dayton later on.

“I’m not a constitutional attorney but I don’t think putting a sales tax on newspapers violates the First Amendment,” Dayton said.

Tom Steward ([email protected]) reports for the Minnesota bureau of Watchdog.org. Used with permission of Watchdog.org.