Nominal interest rates in the United States for financial investments such as bank certificates of deposit and bank savings accounts—the kinds of investments traditionally employed by retired persons and small savers, who wish to gain income without exposing their funds to great risk of capital loss—now fall considerably below the rate of inflation, and hence the real (or inflation-adjusted) yield on such investments is negative.

That is, the nominal payoff is insufficient to offset the loss of purchasing power of the money invested.

Some weeks ago my old friend Richard Rahn, a senior fellow at the Cato Institute and chairman of the Institute for Global Economic Growth, had, without my noticing, written on this issue in a commentary article published in the Washington Times, but he had gone beyond my simple point. Rahn notes that besides suffering the loss of wealth occasioned by the negative real yield on such investments, the investor has to pay tax on the nominal yield—truly a case of the government’s adding insult to injury.

370 Percent Loss

Rahn notes that given the currently prevailing interest rates, rate of inflation, and tax rates, a small investor who earns a nominal yield of 1 percent and pays a 20 percent marginal tax rate, while the rate of inflation is 3.5 percent, actually ends up paying a real tax rate of 370 percent.

For example, an investor buys a $100,000 CD, earns $1,000 in annual interest, pays a tax of $200, and incurs a loss of $3,500 in purchasing power on the invested principal. Total (nominal) income is $1,000; total real tax (nominal tax plus inflation tax) is $3,700.

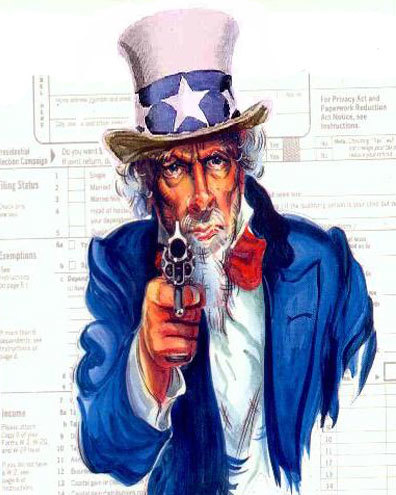

This expropriation of private wealth is not accidental. It is the joint product of the Fed’s near-zero interest-rate policies, the Fed’s money supply increases that underlie the current rate of inflation, and the tax rates established by Congress and administered by the IRS, including the taxation of nominal interest earnings even when they amount to real losses of capital rather than genuine earnings.

The government clearly aims to expropriate private wealth on a massive scale. The only plausible alternative interpretation of these policies requires us to believe that the government officials who set these policies are complete idiots about basic economics.

Huge Expropriation

The expropriation amounts to a huge sum. For example, the value of the non-M1 component of the monetary aggregate M2—consisting of savings and small time deposits, overnight repos at commercial banks, and non-institutional money market accounts—currently amounts to more than $7.5 trillion. If investors lose 2.7 percent on this investment each year (nominal yield minus the sum of the amount lost via taxation of nominal interest and the amount lost via the inflation tax), the loss amounts to about $204 billion.

Because this type of investment is not the whole of the investments subject to this effect, the total amount the government is expropriating comes to a much larger sum.

This taking continues year after year, so long as current conditions persist. The continuation of this expropriation for another year or two will bring the cumulative amount expropriated in this fashion to more than $1 trillion since the onset of the recession and the Fed’s adoption of the near-zero interest-rate policies, along with its allowance of substantial growth of the money stock and the consequent decrease in the money’s purchasing power.

This is a rough calculation for the purpose of illustration. My point does not hinge on a precise estimate, because any well-founded estimate is sure to amount to a gigantic sum.

De Facto Robbery

In sum, the government’s monetary and fiscal authorities are currently engaged in the expropriation of private wealth on a vast scale. Entire classes of investors—especially people who saved during their working years and expected to live on interest earnings on their accumulated capital during their retirement years—are being steadily wiped out.

Astonishingly, this de facto robbery is being committed by a government that misses no opportunity to shed crocodile tears over how single-mindedly it seeks to protect the weak and helpless among us.

Robert Higgs ([email protected]) is senior fellow in political economy for The Independent Institute, editor of The Independent Review, and contributor to The Beacon blog, where a version of this article first appeared. Used with permission.