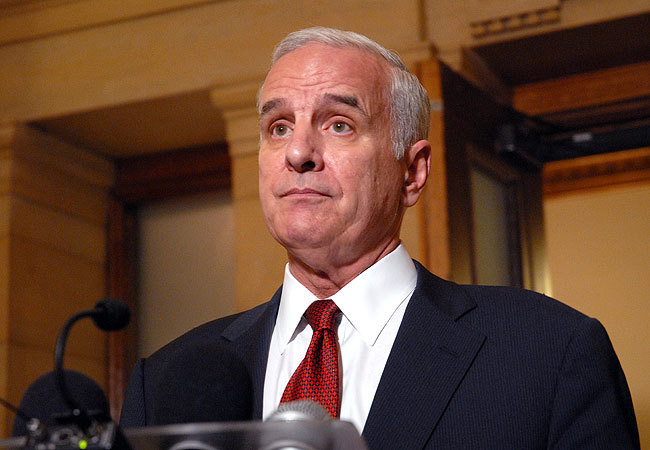

While half dozen states are considering proposals to do away income or corporate taxes Minnesota’s tax and spend Governor Mark Dayton is proposing to increase taxes significantly. No one is safe either as he has proposed tax increases on nearly every group of people imaginable including high income earners, low income earners, tourists, smokers, and businesses. The net result of these tax changes is $2.14 billion in tax increases in the 2014-15 biennium and $3.3 billion in the next biennium.

Peter Nelson, Director of Public Policy at the Center of the American Experiment argues that Governor Dayton’s budget undermines both job growth and economic growth. In a MinnPost editorial, Nelson contends that the budget focuses completely on revenue, violates basic tax reform principles and ignores the role that pensions play in the state’s budget problems.

New Millionaire Tax Hikes

Dayton has proposed a new top marginal tax rate for high-income-earners on several occasions. The proposals, designed to target a group Dayton says is not paying its fair share of taxes. Several states, including Hawaii, Maryland, and New York, have implemented taxes on high-income-earners in recent years.

In his 2011 general fund budget plan, Dayton proposed a new top marginal rate of 10.95 percent for those making more than $85,000 in annual income. The proposal, which failed to pass, included a temporary three-year surcharge of 3 percent on income over $500,000. Now, with the state facing a $1.1 billion budget deficit, Dayton is calling for significant tax reforms including a new high-income tax bracket.

Millionaire Taxes Often Backfire

The revenue-generating results of millionaire taxes have been mixed; many states that increased taxes on the upper brackets, including New York and New Jersey, have allowed their tax hikes to expire.

According to the Tax Foundation’s State and Local Tax Burden Rankings, Minnesota had the seventh-highest tax burden among U.S. states and ranked in the top ten of highest individual income taxes. The report also found Minnesota’s current rate for its highest tax bracket, 7.85 percent on individual income over $77,730 or $137,430 for couples, is already higher than most other top tax brackets in the country.

Personal and corporate income taxes are generally considered to be the most destructive tax because economic growth arises from production, innovation, and risk-taking, factors that are stunted when dollars are taken out of the hands of businesses and individuals through individual and corporate income taxes.

Heartland Institute Director of Government Relations John Nothdurft argued in a Heartland Institute Research & Commentary several reasons why millionaire taxes backfire.

- High taxes encourage the wealthy to move to lower-taxed states, bringing much of their income, capital, and tax revenues with them.

- High taxes discourage capital from flowing into a state, thereby reducing job-creation.

- High taxes make it more difficult to attract high-income people.

- Relying on a small number of taxpayers for a large portion of tax revenue can lead to larger budget deficits than with broader and flatter tax systems.

Pension Reform Must be a Part of Any Tax Proposal

Like many other states and municipalities across the country, Minnesota faces serious problems created by the high cost of traditional defined-benefit public pensions. Dayton’s budget proposals do little to address these problems.

Solutions to these problems do exist. To protect taxpayers and pension beneficiaries in the short term, per-year pension payouts should be capped at a sensible level, the retirement age should be raised, double-dipping should be eliminated, and pension rate of return assumptions should be changed.

According to the National Association of State Retirement Administrators, since 2008 19 public pension plans have lowered the assumed rate of return below 8 percent. Minnesota, along with New York is among the states now considering doing so. Decreasing the expected rate of return, which is used to determine the present value of the funds, will increase the unfunded pension liabilities, making the problem more obvious than it already is.

Cigarette Taxes Are Regressive, Even Dayton Agrees

Particularly of note is Gov. Dayton’s reversal on regressive taxes on cigarettes and expanding the sales tax base.

On the campaign trail in 2010, Gov. Dayton openly opposed these tax hikes. On the cigarette tax, he said, “You raise the price of a pack of cigarettes $1.50…that’s money out of the pockets of working people and poorer people, and that means kids don’t have as much to eat or don’t have the same quality of food. Those are addictions, and I think you treat addictions as addictions and you don’t penalize the people who are dealing with them economically.”

On sales tax expansion, the governor argued that, “taxing all that and turning those service businesses as tax collectors for the state is really a hornet’s nest…it’s more of a regressive tax.”