On Sunday the 21st, Greece goes to the polls.

Greece, like the U.S., U.K. and Brazil had a center-right government at the time of the pandemic. It, like so many other countries, succumbed to the scare that COVID was 10,000 times worse than the ordinary flu (it turned out to be something like 4 times as bad). Accordingly, it shut down the economy and started mailing out checks.

In the case of the U.S., the center-right government fell in 2020. In the case of Brazil, the center-right government fell in 2022.

In the U.K., where the next election is scheduled for 2025, the Conservative Party trails badly in the polls; and, there has been two turnovers of government within the Conservative Party (from Boris Johnson to Liz Truss, and then to Rishi Sunak).

In Greece, the center-right New Democracy Party looks to finish first in Sunday’s election, but well short of a majority, and with no potential coalition partners.

While we await the election, I will review the performance of New Democracy since 2019, when it succeeded Syriza, a radical left-wing party.

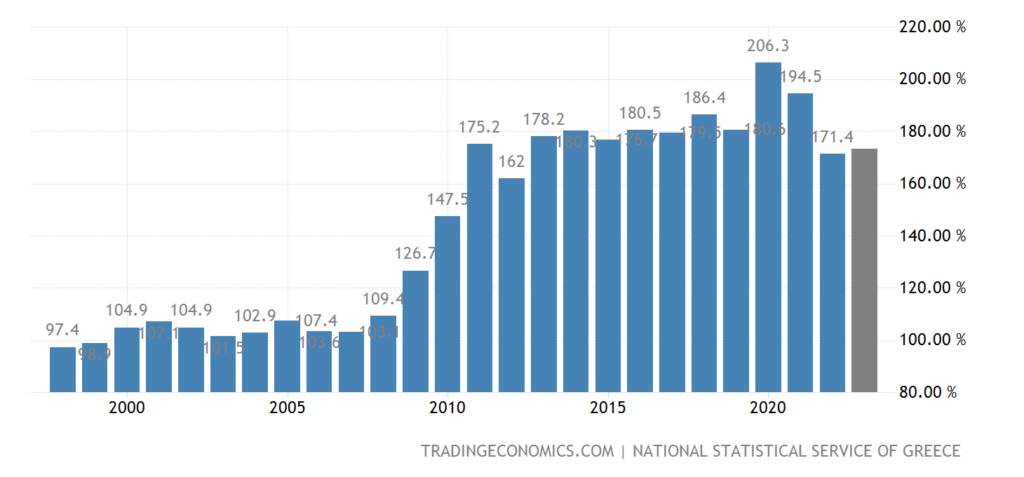

DEBT

During the 2010s, under Syriza, Greece blasted through the Reinhart-Rogoff line (a debt-to-GDP ratio of 90 percent), to debt ratios of about 180 percent. The country was bankrupt and was only sustained by the life-line provided by the European Central Bank. This was a time of austerity, high unemployment, and the fleeing of many young Greeks to northern Europe. Everything was escaping from the Pandora’s Box of excessive debt except, maybe, hope.

Greece, Debt-to-GDP.

With the pandemic and shutdown, Debt-to-GDP rose again in 2020. But, with the revival of the economy, the ratio has recently been falling.

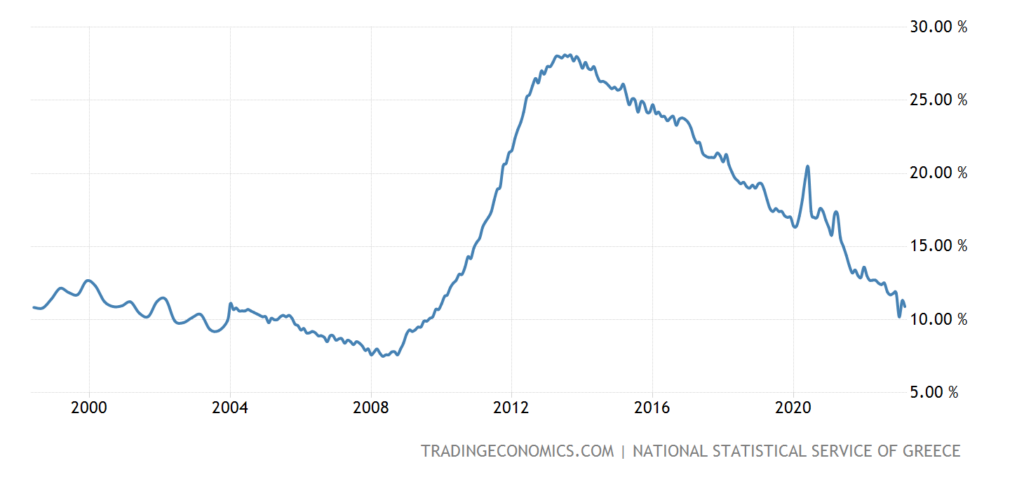

UNEMPLOYMENT

Following the Financial Crisis of 2008, the unemployment rate rose to a Great Depression-like level of 28 percent. In comparison, the unemployment rate rose “only” to 10 percent in the U.S.).

Since then, the unemployment rate has been steadily falling and now approaches 10 percent (as compared to 3.5 percent in the U.S.).

Greece, unemployment rate

INFLATION

If there was a saving grace during the troubled times that followed the Financial Crisis of 2008, it was inflation or, rather, the lack of inflation.

But, with the money bombs of the pandemic and shut-down, inflation jumped to the double-digit range, and has not yet returned to pre-pandemic levels.

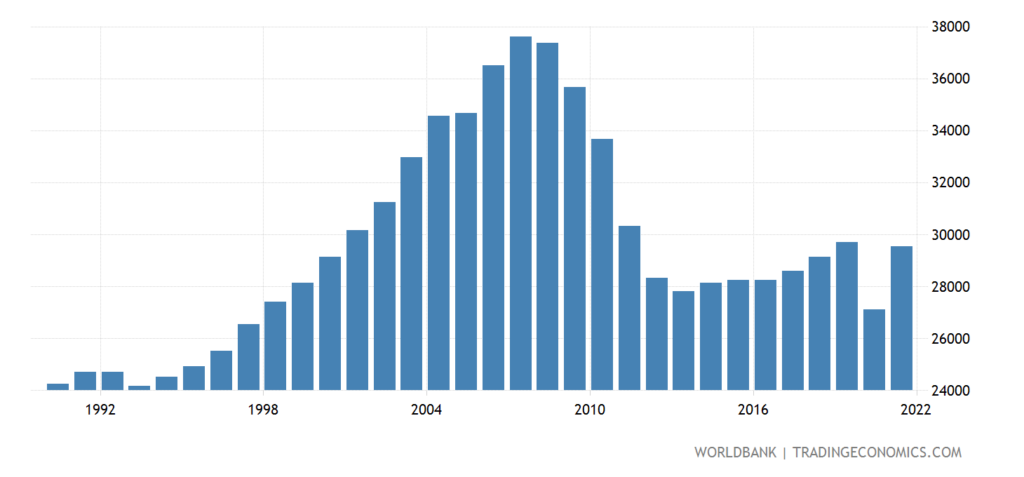

GDP PER CAPITA

To complete our review of the Greek economy, we’ll look at GDP per capita. Following Greece’s joining the EU (in 1981) and converting to the Euro (2001), the country enjoyed strong economic growth.

Perhaps too strong, as the people of Greece went on an unsustainable shopping spree. (The Financial Crisis of 2008 was due to problems originating both in the U.S. and in Europe.)

With the Financial Crisis of 2008, the standard of living crashed, and has hardly recovered.

Greece, GDP per capita ppp-basis (2005 international dollars)

With a lot of help from the outside, New Democracy was able to stabilize the fiscal position of the country and make some progress in unemployment and the standard of living. This moderate success was undermined by the pandemic and shut-down. Now the people of Greece have the choice of returning to the long and hard work of bringing the debt of the country to a sustainable level, or denying that the indebtedness of the country is a problem at all.