Originally published in Master Resource.

We are in the midst of history’s greatest wealth transfer. Government subsidized support for wind systems, solar arrays, and electric vehicles overwhelmingly benefits the wealthy members of society and rich nations. The poor and middle class pay for green energy programs with higher taxes and higher electricity and energy costs. Developing nations suffer environmental damage to deliver mined materials needed for renewables in rich nations.

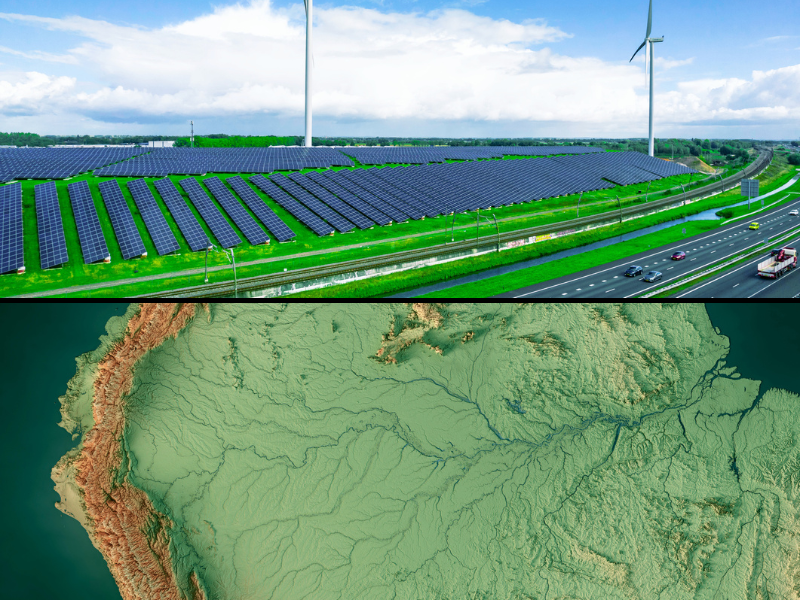

Since 2000, the world has spent more than $5 trillion on green energy. More than 300,000 wind turbines have been erected, millions of solar arrays were installed, more than 25 million electric vehicles (EVs) have been sold, hundreds of thousands of acres of forest were cut down to produce biomass fuel, and about three percent of agricultural land is now used to produce biofuel for vehicles. The world spends about $1 trillion per year on green energy. Government subsidies run about $200 billion annually, with more than $1 trillion in subsidies spent over the last 20 years.

World leaders obsess over the need for a renewable energy transition to save the planet from human-caused global warming. Governments deliver an endless river of cash to promote adoption of green energy. The Inflation Reduction Act of 2022 provided $370 billion in subsidies and loans for renewables and EVs. But renewable subsidies and mandates overwhelmingly favor the rich members of society at the expense of the poor.

Wind systems receive production tax credits, property tax exemptions, and sometimes receive payments even when not generating electricity. Landowners receive as much as $8,000 per turbine each year from leases for wind systems on their land. Lease income can be quite high for a landowner with many turbines. In England, ordinary taxpayers pay hundreds of millions of pounds per year in taxes that are funneled as subsidies to wind companies and wealthy land owners.

In the US, 39 states currently have net metering laws. Net metering provides a credit for electricity generated by rooftop solar systems that is fed back into the grid. Solar generators typically get credits at the retail electricity rate, about 14 cents per kilowatt-hour. This is a subsidized rate, which is more than double the roughly five cents per kilowatt-hour earned by power plants. Apartment residents and homeowners that cannot afford to install rooftop solar pay higher electricity bills to subsidize homes that receive net metering credits. Rooftop solar owners also receive federal and state tax incentives, another wealth transfer from ordinary citizens.

US federal subsidies of up to $7,500 for each electric car purchased, along additional state subsidies, directly benefit EV buyers. The average price of an EV in the US last year was $66,000, which is out of reach for most drivers. A 2021 University of Chicago study found that California EV owners only drive 5,300 miles per year, less than half the mileage for a typical car. Most electric cars in the US are second cars for the rich.

A mid-size electric car needs a battery that weighs about a 1,000 pounds to provide acceptable driving range. Because of battery weight, EVs tend to be about 50 percent heavier than gasoline cars, which causes increased road damage. But EVs don’t pay the road tax included in the price of every gallon of gasoline. EVs should pay higher road taxes than traditional cars, but today this cost is borne by everyday gasoline car drivers.

Renewable systems require huge amounts of special metals. Electric car batteries need cobalt, nickel, and lithium to achieve high energy density and performance. Magnets in wind turbines require rare earth metals, such as neodymium and dysprosium. Large quantities of copper are essential for EV engines, batteries, wind and solar arrays, and electricity transmission systems to connect to remote wind and solar sites. According to the International Energy Agency, an EV requires about six times the special metals of a gasoline or diesel car. A wind array requires more than ten times the metals of a natural gas power plant on a delivered-electricity basis. The majority of these metals are mined in developing countries.

Almost 70 percent of cobalt is mined in the Democratic Republic of the Congo. Indonesia produces more than 30 percent of the world’s nickel. Chile produces 28 percent of the copper. China produces 60 percent of the rare earth metals. These nations struggle with serious air and water pollution from mining operations. Workers in mines also suffer from poor working conditions and the use of forced labor and child labor practices. But apparently no cost is too great so that rich people in developed nations can drive a Tesla.

To top it off, the European Union recently approved a Carbon Border Adjustment Mechanism (CBAM). The CBAM will tax goods coming from poor nations which aren’t manufactured using low-carbon processes. CBAM revenues will be a great source of funds for Europe’s green energy programs that benefit the wealthy.

In January, California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington proposed a wealth tax on billionaires. It’s interesting to note that all seven of these states mandate and heavily subsidize wind and solar arrays and electric vehicles, which transfer wealth from poor and middle-class residents to those same billionaires.