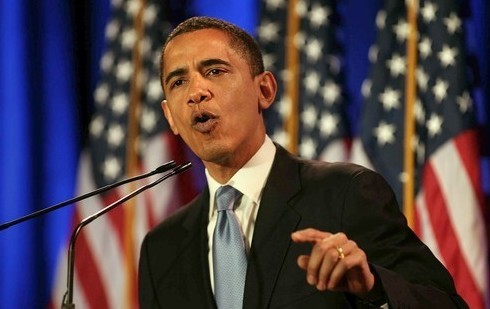

The central theme of President Obama’s tax policy has been that “the rich” (whatever that is supposed to mean) do not pay their fair share of federal taxes, and the middle class pays more as a result. But the CBO just issued a new report this month that proves him grievously wrong.

“The Distribution of Household Income and Federal Taxes, 2008 and 2009,” issued by CBO on July 12, reports that the top 1% of income earners paid 39% of federal individual income taxes in 2009, while earning 13% of the income. That means their share of federal income taxes was three times their share of income.

And that is down from 2007, before President Obama was even elected. In that year, after 25 years of Reagan Republican tax policies, the top 1% paid 40% of federal individual income taxes. That was more than double the 17.6% of federal individual income taxes paid by the top 1% when President Reagan entered office in 1981.

Also in 2007, again before Obama was even elected, and after 25 years of Reaganomics, the bottom 40% of income earners on net as a group paid less than 0% of federal income taxes. Instead of paying at least some income taxes to help support the federal government, the federal government paid themcash through the income tax code.

Does that reality sound like what you hear in President Obama’s deceiving speeches?

CBO further reported that in 2009 the top 20% of income earners, those earning more than $74,000, paid 94% of federal individual income taxes, virtually all of the net total. That was 85% more than the share of national income they earned.

CBO further reported that in 2009 the top 20% of income earners, those earning more than $74,000, paid 94% of federal individual income taxes, virtually all of the net total. That was 85% more than the share of national income they earned.

Yet, in that same year, the middle 20% of income earners, the true middle class, paid 2.7% of total federal individual income taxes on net, while earning 15% of before-tax income. And the bottom 40% of income earners, instead of paying some income taxes to support the federal government, were paid by the IRS cash equal to 10% of federal individual income taxes on net.

That means altogether the bottom 60% of income earners, which includes the middle class, paid less than 0% of total federal individual income taxes as a group on net. Instead, as a group, they received net cash payments from the IRS on net.

And for the Marxist propagandists that are paid to comment on these columns, no this does not mean I want to raise taxes on the bottom 60%. I supported all the Reagan Republican initiatives over the past generation that abolished federal income taxes on the poor, and what the Left calls the working class, and almost abolished them completely on the middle class.

That began with the Earned Income Tax Credit (EITC), which grew out of then Governor Ronald Reagan’s famous testimony before the Senate Finance Committee in 1972, where he proposed exempting the working poor from all Social Security and income taxes as an alternative to welfare, with the credit serving as a way to offset payroll taxes for the poor and low income workers. As President, Reagan cut federal income tax rates across the board for all taxpayers by 25%. He also indexed the tax brackets for all taxpayers to prevent inflation from pushing working people into higher tax brackets.

In the Tax Reform Act of 1986, President Reagan reduced the federal income tax rate for middle and lower income families all the way down to 15%. That Act also doubled the personal exemption, shielding a higher proportion of income from taxation for lower income workers than for higher income workers.

Newt Gingrich’s Contract with America adopted a child tax credit of $500 per child that also reduced the tax liabilities of lower income people by a higher percentage than for higher income people. President Bush doubled that credit to $1,000 per child, and made it refundable so that low-income people who do not even pay $1,000 in federal income taxes could still get the full credit. Bush also adopted a new lower tax bracket for the lowest income workers of 10%, reducing their federal income tax rate by 33%.

That is how we reached the point by 2007 where the bottom 40% of income earners as a group on net were being paid by the federal income tax code instead of paying federal income taxes. So when then candidate Obama said in 2008 that Republicans cut taxes for the rich, but haven’t “given a break to folks who make less,” was he ignorant or lying?

We know that when Obama’s campaign today runs those silly ads all over the internet that Romney proposes to raise taxes on the middle class Obama is lying. Not only has Romney proposed no such thing, but House Republicans have already voted for Rep. Paul Ryan’s tax reform plan that would cut the federal income tax rate for all families earning less than $100,000 to 10%, and Romney has endorsed that as well, consistently with the entire history of Republican tax policy cutting federal taxes for the middle class, as discussed above. The foolish Obama contributors that finance those dishonest ads should be held personally accountable.

I have even argued in print before that Republicans and conservatives should just abolish the remaining minor share of federal income taxes paid by the middle class. That would enable a rational flat tax to be adopted for the top 40% of income earners, who earn 72% of all income anyway. Then Warren Buffett would pay the same tax rate as his highly paid secretary. The last two Democrat Presidents were elected campaigning on a tax cut for the middle class, then never delivered a permanent cut after elected. But with income taxes for the middle class eliminated, that game would be over.

Republicans could still campaign for the votes of middle and lower income workers by explaining that the spending plans of liberal Democrats would ultimately require federal taxes to be reimposed on them. And that Democrat tax increases on “the rich” would just bring back the bad old days of Obamanomics, with no new jobs and declining real wages.

Left wing apologists for tax piracy argue that the above statistics only account for income taxes and not the payroll taxes that working people still do pay. But that is proper, because President Obama argues that the rich do not pay their fair share of federal income taxes, not payroll taxes, and it is federal income taxes that he is proposing to increase on those grounds, not payroll taxes. Moreover, I and other conservative Republicans have argued that payroll taxes should be phased out entirely and replaced by personal savings, investment and insurance accounts instead, relieving middle and lower income workers of those taxes entirely.

In addition, payroll taxes are paid in return for specific entitlement benefits or services, and so all should pay an equivalent amount proportionate to those benefits. The payroll tax consequently is not supposed to be progressive, and should not be.

Nevertheless, even counting payroll taxes as well as all other federal taxes, the story is the same. The “rich” and upper income workers still pay almost all federal taxes, with the middle class and lower income workers paying far lower proportions and rates.

CBO reports that in 2009, the top 1% paid over 22% of all federal taxes, while earning 13% of the income. And that is down under Obama from the nearly 27% of all federal taxes paid by the top 1% achieved by Reaganomics in 2007.

Moreover, in 2009 the top 20% paid nearly 70% of all federal taxes, while earning 50% of the income. The middle 20% of income earners, again the true middle class, paid 9% of federal taxes, less than two-thirds their share of income. The top 1% alone paid way over twice the share of total federal taxes as the entire middle 20%. The bottom 20% paid 0.3% of all federal taxes.

In addition, in 2009 the top 1% paid an average federal tax rate of 29%. In contrast, the middle 20% paid an average federal tax rate of only 11.1%. The bottom 20% paid an average federal tax rate of 1%. So much for Warren Buffett, who is as dishonest as President Obama on the issue, for his own selfish interests. (He runs the nation’s largest tax shelter, and so expects more customers if tax rates rise on “the rich”).

President Reagan was called the Great Communicator. That is because even with a Democrat controlled House of Representatives, and the bitter opposition of the Democrat controlled, so-called mainstream media, he rallied the nation to support fundamental change in federal policies that ended the stagflation of the 1970s and produced unprecedented economic growth and prosperity for a generation.

President Obama, who has done everything during his Administration exactly the opposite of President Reagan, has earned the label “the Great Deceiver.” He has spent the last 3 ½ years barnstorming the nation promoting just the opposite of reality, based on what CBO has just reported. That is just more of his Calculated Deception, trying to take advantage of what he thinks most people do not know, and his party controlled “mainstream media” won’t tell them. But a President who runs for reelection trying to inflame some Americans against others based on such gross dishonesty does not deserve to even be running for office, and such a campaign disgraces the Democrat Party nominating him.

Eric Hoffer famously said, “An empty head is not really empty; it is stuffed with rubbish. Hence the difficulty of forcing anything into an empty head.” That accurately describes Obama’s supporters today, who fanatically cling to his Through the Looking Glass perversion of reality, and will actually denounce correction. Hoffer also famously said, “Propaganda does not deceive people; it merely enables them to deceive themselves.” Those who allow themselves to be deceived by President Obama’s dishonest perversion of reality just reveal that they have the personal morality of pirates.