Illinois has an unfunded pension liability of nearly $100 billion—the worst in the nation, according to official government numbers.

The problem grows by $21 million every day lawmakers fail to enact reform. This debt growth, coupled with the fact that the quickly growing pension payments continue to crowd out resources for core government services, should have been reason enough for lawmakers to enact reform during the recent spring legislative session.

Instead, political leadership punted on pension reform in the legislative session ended May 31—a move that resulted in back-to-back credit rating downgrades.

Fitch, Moody’s Slap State

Fitch Ratings downgraded Illinois’ credit rating to “A-” from “A,” calling the state’s pension liability “unsustainable.” The agency said it was concerned about the state being able to deal with its “numerous fiscal challenges.”

Moody’s Investors Service quickly followed suit and downgraded Illinois’ rating to “A3” from “A2”. The rating agency also said it has a negative outlook on Illinois’ credit.

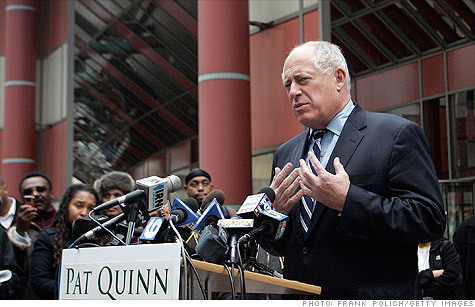

That makes 13 downgrades since Gov. Pat Quinn (D) took office in 2009. Illinois’ rating stands only a few notches away from junk-bond status, meaning many institutional investors will no longer be able to buy Illinois debt.

That also means taxpayers will be forced to pay even higher penalty rates when the state borrows money. Illinois already pays the highest borrowing penalty rate in the nation—nearly three times higher than California’s.

Borrowing and More Borrowing

Borrowing is one of the many pension “fixes” lawmakers have used in the past. Former Gov. Rod Blagojevich borrowed $10 billion to pay for pensions. Quinn, his successor, has borrowed another $7 billion for the same purpose.

But after practically maxing out the state’s credit card, tapping the bond market is no longer an option.

Instead of implementing real reforms, lawmakers hit taxpayers with a record $7 billion annual tax hike in 2011. Eighty cents of every 2012 tax-hike dollar went to pay for pensions.

As if that weren’t enough, lawmakers want to pass another multibillion-dollar income tax hike—a progressive income tax to replace the state’s flat tax. Quinn said passing a progressive income tax is “one of my goals before I stop breathing.”

Borrowing money and increasing taxes to cover up Illinois’ pension crisis will not solve the problem. The back-to-back credit downgrades only serve to highlight just how bad the pension problem really is.

The deeper problem behind higher borrowing costs lies in the negative message these downgrades hold.

‘Another Reason Not to Invest’

“The biggest issue surrounding these credit downgrades is the message they send to investors, job creators, and entrepreneurs,” said Ted Dabrowski, vice president of policy at the Illinois Policy Institute. “Illinois’ rock-bottom credit rating gives businesses another reason not to invest in Illinois; tells Illinois’ college students that it’s going to be even more difficult to find opportunity in this state; and it tells everyone struggling in Illinois that the state’s future and their future are at great risk.”

Behind the borrowing, tax grabs, and downgrades is the core of Illinois’ pension problems—the defined benefit model. Illinois’ pension systems are in such crisis because lawmakers have continued growing the defined benefit plan instead of following the lead of 85 percent of the private sector by embracing 401(k)-style retirement plans.

The only way to turn the seemingly endless cycle of credit downgrades around and set the stage for a brighter future in Illinois is through real reform. Illinois can prosper if lawmakers eliminate the defined benefit system.

Plan to Halve Pension Debt

The good news is, a pension solution was introduced during the recent spring session that would solve the problem: House Bill 3303 (and accompanying Senate Bill 2026). This plan cuts unfunded pension debt in half and includes a 401(k)-style defined contribution plan as the main pillar of its reforms, while protecting already earned benefits for government workers.

A comprehensive pension solution focused on 401(k)-style retirement plans is a necessary first step in ending the cycle of credit downgrades and setting the foundation for a positive economic outlook for government workers, taxpayers, and businesses in Illinois.

Ben VanMetre ([email protected]) is senior budget and tax policy analyst at the Illinois Policy Institute.