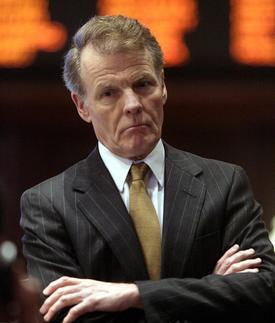

Three years ago the Democrat-dominated Illinois General Assembly raised the state’s personal income tax rate from 3 percentage points to 5 percentage points, a 67 percent increase in the tax rate. Now Michael Madigan, a Chicago lawyer and Democrat politician who has spent 44 years in the General Assembly, including 30 years as House Speaker, is calling for a special tax on “millionaires.”

“This plan brings long overdue fairness to the state tax structure and provides a needed boost to education funding to help give our children more of the resources they need to succeed,” Madigan said of his plan for a 3 percentage-point “surcharge” on million dollar incomes in a statement.

Billions More $$$, Worsening Finances

“He and his legislative colleagues will have collected more than $31 billion in new tax revenues by the time the temporary tax hike sunsets in January 2015, and now they want more,” said Ted Dabrowski, vice president of policy at the Illinois Policy Institute.

Despite billions of dollars more revenue, Illinois’ fiscal situation under Madigan’s leadership has worsened, with the state having the nation’s worst pension funding, lowest credit rating among the 50 states, and second-highest unemployment rate. But Dabrowski says this latest tax increase proposal from the state’s most powerful politician is designed mainly to be a “bailout” of Chicago, where the public school pension system is $8 billion in debt and the annual pension contribution has skyrocketed to $613 million this year.

Madigan’s plan for an income tax “surcharge” would be retroactive to January 1, 2014. Under his formula, this would give Chicago another $400 million in new revenues for 2014 and 2015, noted Dabrowski.

On a different but related front, some Democrat legislators are also calling for the 5 percent tax rate to stay where it is or go to 4.9 percent instead of falling to 3.75 percent in 2015, as they promised would happen when they passed the rate increase in 2011. On Wednesday, Gov. Pat Quinn (D), who backed the “temporary” 67 percent increase in the income tax rate, released a budget proposal calling for the tax increase to be made permanent.

Push for ‘Progressive’ Tax

Madigan’s plan would gut the state’s flat income tax, in which the current 5 percent rate applies to everyone who files state income taxes. The Illinois constitution says the income tax rate must be the same for everyone, but legislation under consideration in the General Assembly would allow for a “graduated” or “progressive” income tax with multiple rates that rise as taxable income rises.

Liz Malm, an economist at the non-partisan Tax Foundation, said going to a progressive income tax would result in a tax increase on more than 60 percent of Illinois employers because most businesses pay taxes through the individual income tax instead of through the corporate income tax.

Heavier Burden on Employers

“With the state still in recovery mode after the recession, the effect of taxes on Illinois’ businesses should not be understated,” said Malm. “It’s crucial that lawmakers and taxpayers understand that increased individual income taxes would inevitably increase taxes on small businesses and employers throughout the state.”

David From, Illinois state director of Americans for Prosperity, also said the Madigan and progressive income tax proposals would further hurt jobs prospects:

“With the second-highest unemployment rate in the nation, one would think the Democrat leaders of Illinois would want to grow jobs for our families. Unfortunately, yet again they choose to pursue policies that will push more jobs out of the Land of Lincoln by punishing job creators,” he said in a statement.