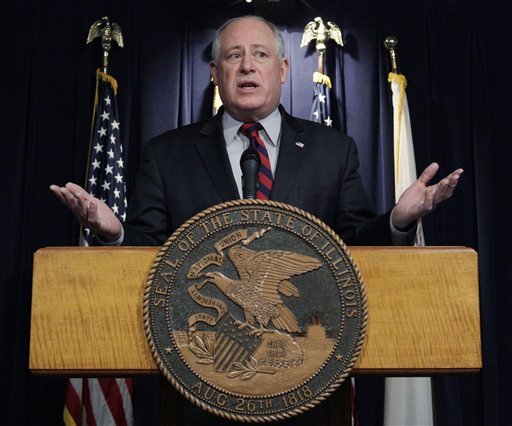

The Illinois legislature sent Gov. Pat Quinn a Medicaid reform and tax package that falls short of his stated goals and raises cigarette taxes to help address a $2.7 billion Medicaid shortfall.

The legislative package sent to the governor on June 7 would cut $1.6 billion from several state programs, increase cigarette taxes by $1 per pack, curtail the practice of pushing back Medicaid bills from one year to the next, and implement the Medicaid expansion mandated under President Obama’s health care law for about 250,000 people in Cook County.

The legislation would preserve the amount of federal matching funds Illinois receives for spending on Medicaid, says Jonathan Ingram, a health care policy analyst at the Illinois Policy Institute.

“Lawmakers promised to reduce Medicaid expenditures by $2.7 billion. They fell far short of this mark, opting instead for higher taxes and more spending. By keeping Medicaid spending at unaffordable levels, they’ve endorsed a plan that would make the repeal or sunset of last year’s historic income tax hike all but impossible.”

Short-Term Patch

State Sen. Kirk Dillard (R-Burr Ridge) said the cigarette tax won’t solve Illinois’s long-term funding problem.

“There are two problems with a cigarette tax to feed the Medicaid beast. The first is that a tax on cigarettes is a regressive tax, and second, we just drive our sales tax revenues to surrounding states,” Dillard said.

Ingram agrees.

“Research conducted by the Mackinac Center for Public Policy found the proposal to hike cigarette taxes by $1 per pack would quadruple the rate of tobacco smuggling. While it would raise revenues, our estimates indicate smuggling alone would limit the take to about $250 million,” Ingram said. “When tobacco tax revenues fall short, as they typically do, other taxpayers will be on the hook for the shortfall. That’s why 70 percent of tobacco tax hikes are followed by other tax hikes within two years.”

‘The Easy Way Out’

Dillard says the legislation would “overload an already-broken system with hundreds of thousands of new people as part of an overall ‘reform package’ that will hurt taxpayers at a time of record government spending, deficits and debt.”

“You don’t get at the real problem, which is the structural imbalance in Medicaid spending. We need to make real, tough cuts in Medicaid eligibility, and make sure we spend our money more wisely, rather than just throw more money at it,” Dillard said. “The cigarette tax was the easy way out, and does not help us two and three years down the road, because we still have not made all of the tough decisions we need to fix a Medicaid program that is out of control.”