Nobody likes bad news bears and who’s to say the January headline increase of 353,000 payroll jobs is not a good number? Certainly not Trump NEC Chairman Larry Kudlow who calls it “a blowout” jobs report and who faults his “conservative friends” for “trying to drill holes” in it. “It is what it is,” he says. “It’s a very strong report. Not every economic stat should be viewed through a political lens.”

Well. I’m another former Reagan administration economist and I don’t think my “lens” is out of whack.

The January report is notoriously noisy because of changes in the Bureau of Labor Statistics (BLS) seasonal adjustment factors that are put into place the first of every year. As a former advisor to the BLS, I know that its economists have to struggle with an increasingly flawed set of data that the nation’s businesses report to them at an increasingly unresponsive rate. I used to report my company’s payroll numbers and I had a terrible time retrieving the data. There is a reason the BLS labels its initial monthly report “preliminary.” Last year the good BLS economistshad a terrible time getting reliable data, repeatedly making substantial revisions to the preliminary numbers. They just cut last March’s estimate by 90,000 jobs!

As former Obama NEC Chairman Larry Summers, no right-wing curmudgeon, observes, the BLS household employment survey should also be considered, registering a preliminary gain of 201,000 jobs following the BLS’ January revisions, closer to the consensus forecast of a 160,000 increase than to the headline increase that Mr. Kudlow calls a “blowout.”

And the ADP/Stanford Digital Laboratory reported a gain of just 107,000 jobs. Economists at the Federal Reserve Board of Governors and the University of Michigan conclude that “the timeliness and frequency of the ADP payroll microdata substantially improves forecast accuracy for both current-month employment and revisions to the BLS CES [payroll] data.” (Emphasis added.)

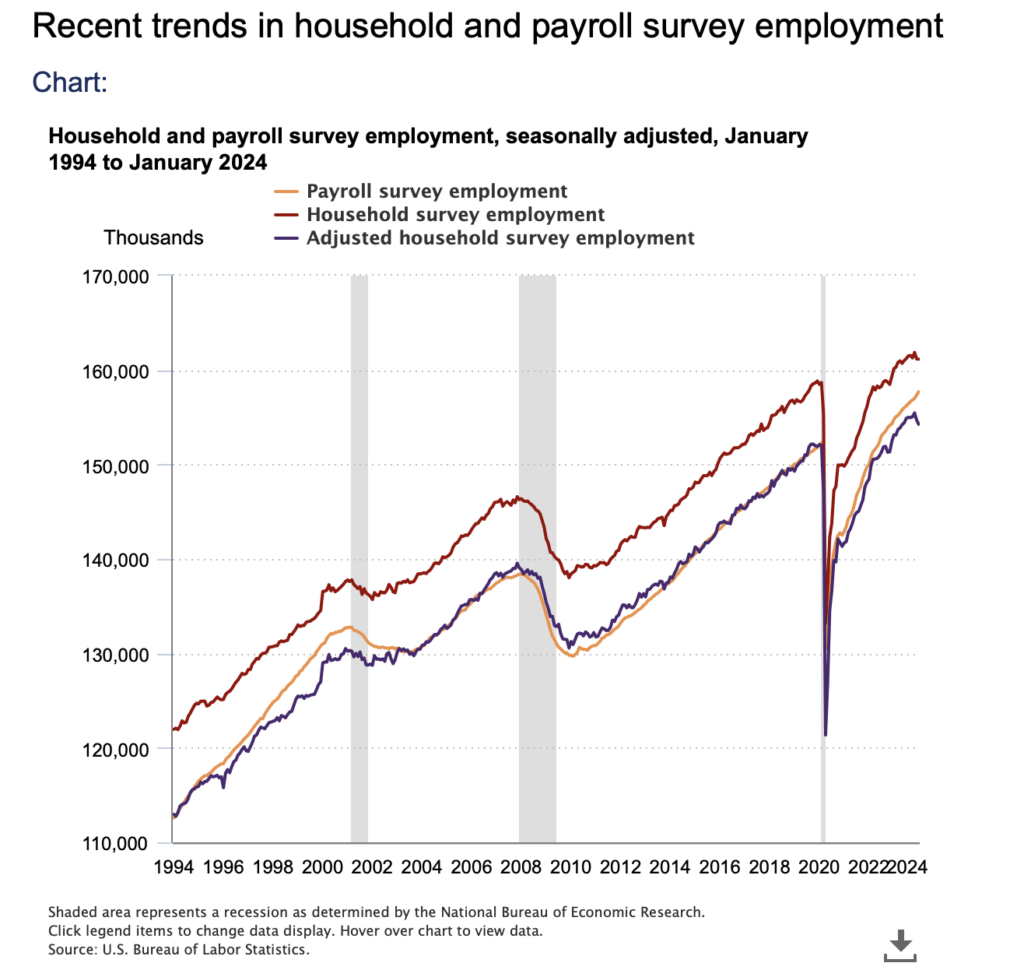

Summers has suggested that the BLS payroll and household survey data be averaged to get the best idea of what’s going on every month. I prefer a third, “adjusted household survey” series that makes the household data roughly comparable to the payroll number. The January number fell by 211,000 jobs.

The payroll measure is based on a much larger sample with, at first blush, a much smaller month-to-month statistical error margin, which disappears in the long run. Last year the payroll number grew 33% faster than the adjusted household number, with a fourth quarter gain of 680,000 jobs versus a loss of 253,000 jobs in the adjusted household survey as 270,000 people lost their jobs

Nobody knows just why there’s such a discrepancy. But the survey response rate for the payroll report has fallen from nearly 80% in 2003 to just over 40% today. “The lower your response rate, the smaller your original sample group becomes,” says Survey Monkey. . . . “With a 100% response rate, we’d have an industry standard margin of error of 5%. Lower our response rate to a relatively high 32%, and we are now looking at a 10% margin of error, effectively cutting the accuracy of your survey findings in half.” (Emphasis added.)

The problem is perhaps best illustrated by the poll of ten million Americans who favored Alf Landon over Franklin Roosevelt by a 14 point margin prior to the 1936 presidential election, but where Roosevelt won by 25 points. “Only” 2.4 million responded to the survey, resulting in a “special type of selection bias where reluctant and nonresponsive people are excluded from the sample.” (

The household survey response has fallen from 90% to 70% over the past 10 years: not good, but much better than the 40% rate for the payroll numbers.

The payroll number that I used to report to the BLS shows how many jobs are out there, not how many people have a job. That is to be found in the household survey. It’s scarce consolation for working people when the number of jobs reported from corporate payrolls goes up when they must take another job to make ends meet. Last year an additional 260,000 workers got another job that was counted as another job in the headline payroll report.

I’m a Reagan Republican. But I don’t think my lens is dirty. It’s time to retire the payroll number.

Dr. Thomas Walton is a Heartland Policy Advisor. In the past he was Director of Economic Policy Analysis at General Motors, Special Advisor for Regulatory Affairs to FTC Chairman James Miller, and Vice Chair of the Business Advisory Committee to the Bureau of Labor Statistics. He also served on the Board of Directors of The Heartland Institute from 2001 to 2009.