Inflation is a dangerous and devastating monetary policy to be followed by any government. Ninety years ago, on November 15, 1923, the Great German Inflation came to an end when the monetary printing presses were finally shut down, and the economic havoc came to an end. Its lessons are worth remembering.

The German people had gone through nine years of ever-greater monetary expansion, ever-more soaring prices, the financial destruction of much of the society’s middle class, a massive misdirection and squandering of the country’s productive capital in an illusionary economic boom, and the ruin of much of Germany’s social fabric. The inflationary madness ended in a virtual total collapse of the German mark.

The German inflation began—as many other inflations have begun throughout history— through the government’s turning to the printing press to finance its war expenditures. Almost immediately after the start of World War I, on July 29, 1914, the German government suspended all gold redemption for the mark.

Less than a week later, on August 4, the German Parliament passed a series of laws establishing the government’s ability to issue a variety of war bonds that the Reichsbank—the German central bank—would be obliged to finance by printing new money. A new set of Loan Banks was created to fund private-sector borrowing, as well as state and municipal government borrowing, with the funds for the loans simply being created by the Reichbank.

German Wartime Inflation – and Postwar Hyperinflation

During the four years of war, from 1914 to 1918, the total quantity of paper money created for German government and private sector spending went from 2.37 billion to 33.11 billion marks. By an index of wholesale prices (with 1913 equal to 100), prices had increased more than 245 percent (prices failed to increase far more due to wartime price controls).

In 1914, 4.21 marks traded for one dollar on the foreign exchange market. By the end of 1918, the mark had fallen to 8.28 to the dollar.

But the worst was to come in the five years following the end of the war. Between 1919 and the end of 1922 the supply of paper money in Germany increased from 50.15 billion to 1,310.69 billion marks. Then in 1923 alone the money supply increased to a total of 518,538,326,350.00 billion marks.

By the end of 1922 the wholesale price index had increased to 10,100 (still using 1913 as a base of 100). When the inflation ended in November 1923, this index had increased to 750,000,000,000,000.

The foreign-exchange rate of the mark had decreased to 191.93 to the dollar at the end of 1919, to 7,589.27 to the dollar in 1922, and then finally on November 15, 1923, to 4,200,000,000,000.00 marks for one dollar.

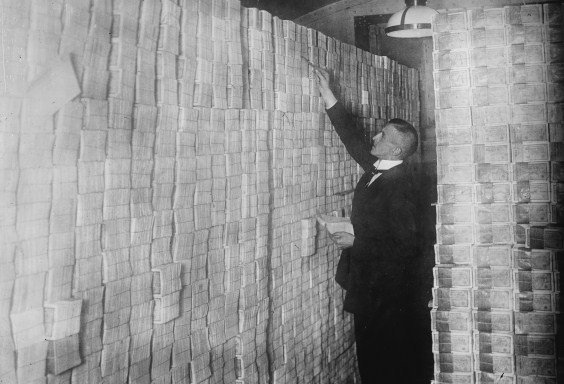

During the last months of the Great Inflation, according to German free market economist, Gustav Stolper, “more than 30 paper mills worked at top speed and capacity to deliver notepaper to the Reichsbank, and 150 printing firms had 2,000 presses running day and night to print the Reichsbank notes.”

The Human Cost of Monetary Destruction

But these statistical figures do not tell the human impact of such a catastrophic collapse of a country’s monetary system. In his book, “Before the Deluge: A Portrait of Berlin in the 1920s” (1972), Otto Friedrich writes that:

“By the middle of 1923, the whole of Germany had become delirious. Whoever had a job got paid every day, usually at noon, and then ran to the nearest store, with a sack full of banknotes, to buy anything that he could get, at any price. In their frenzy, people paid millions and even billions of marks for cuckoo clocks, shoes that didn’t fit, anything that could be traded for anything else.” The price of a cup of coffee would double in the time that a customer took to drink it in a Berlin café.

Food supplies became both an obsession and a currency. The breakdown of the medium of exchange meant that the rural farmers became increasingly reluctant to sell their agricultural goods for worthless paper money in the cities. Urban dwellers streamed back to the countryside to live with relatives in order to have something to eat. Anything and everything was offered and traded directly for food to stave off the pangs of hunger.

Inflation-Caused Distortions and Imbalances

The inflation generated a vast and illusionary economic boom. In his classic study, “The Economics of Inflation” (1931), Constantino Bresciani-Turroni detailed how the inflation distorted the structure of prices and wages, generating paper profits that created a false conception of wealth and prosperity.

Austrian economist Ludwig von Mises was the first one to emphasize this aspect of the inflationary process, and how it distorted the ability for the rational economic calculations of what was a profit and when there was a loss.

As the selling price of a manufactured good was pushed far above the cost of production, profits appeared huge. But when the manufacturer went back into the market to begin his production process again, he found that the costs of resources and labor had also dramatically increased. What had looked like a profit was not enough to replace the capital used up earlier.

The distorted relative-price signals during the inflation resulted in misallocations of capital and labor in various investment projects that were found to be unsustainable and unprofitable when the monetary debauchery finally came to an end.

Thus a “stabilization crisis” followed the inflation, as capital and investment projects were left uncompleted because of a lack of available real resources, and workers faced a period of unemployment as they discovered that the jobs the inflation had drawn them into had now disappeared.

The consumption of capital and the misuse of resources and labor during the years of inflation left the German people with a far lower real standard of living, which only years of work, savings, and sound new investment could make up for.

A False Recovery as a Prelude to Hitler

Unfortunately, Germany’s economic recovery in the middle and late 1920s turned out to be an illusion as well. A game of financial musical chairs was played out, in which Germany borrowed money from the United States to pay off financial reparations to the victorious Allied powers, as well as to fund a vast array of municipal public-works projects and government-sponsored business investment activities.

These all came crashing down, too, when the boom of the 1920s turned into the Great Depression of the 1930s. It also set the political stage for Adolf Hitler’s rise to power in 1933, with the consequences of Nazi dictatorship, fascist-style government economic planning, economy-wide imbalances and distortions created by “repressed inflation” (a huge monetary inflation to feed Nazi public works projects and military rearmament hidden from public view due to comprehensive wage and price controls), and finally a war in Europe that took that lives of tens of millions of people.

The “Little Bit of Price Inflation” that Easily Gets Out of Control

Today in the United States and Europe, the monetary central planners in charge of the Federal Reserve System and the European Central Bank (as well as those running central banks in virtually all major countries in the world), are insisting that “a little bit of price inflation” is a good thing to “stimulate” their respective economies.

But once embarked upon, as the Federal Reserve has been doing already, the politics as well as the economics of inflation make it always threatening to develop into the reality of “a little more and more and more,” until finally the stability of the entire society is thrown into doubt as a result of monetary madness. The anniversary of the end of the Great German Inflation should be a reason to pause and think before we travel too far down a very dangerous road.

[Originally published on Epic Times]