Inflation Report Belies Tariff-Effect Predictions

Forward this issue to your friends and urge them to subscribe.

Read all Life, Liberty, Property articles here, and full issues here and here.

IN THIS ISSUE:

- Inflation Report Belies Tariff-Effect Predictions

- Video of the Week: Climate and Energy in Trump’s Big Beautiful Bill – The Climate Realism Show #158

- World Bank Backs Trump

- Crypto Plan for Social Control?

- Cartoon

- Bonus Video of the Week: Hurricane Season Preview with guest Stan Goldenberg – The Climate Realism Show #161

Inflation Report Belies Tariff-Effect Predictions

The consensus prediction about President Donald Trump’s massive program of tariffs was that it would cause rapid and highly damaging price inflation. The Wall Street Journal was prominent in conveying those claims, and the Federal Reserve (Fed), the U.S. central bank, concurred, forecasting that the tariffs would cause inflation.

Those predictions have not come true. The Wall Street Journal reports:

Inflation was tame in May, defying fears that the impact of President Trump’s tariffs would start to show a rise in prices.

Consumer prices rose 0.1% in May over the previous month, less than economists anticipated. Year-over-year inflation was 2.4%, in line with expectations and near a four-year low recorded in April.

The inflation report was much different from what the conventional wisdom said would happen:

For months, businesses have warned that they will raise prices in response to Trump’s tariffs, and economists had expected tariff-related price hikes for items such as cars and clothing to show up in the May numbers of the consumer-price index.

Wednesday’s report doesn’t provide definitive evidence this happened, with prices of cars and clothing declining rather than rising. The report will raise questions over when a widely anticipated bump in prices this summer, expected by the Federal Reserve and private-sector economists, will materialize—and whether it will be as stiff as some have warned.

ZeroHedge provided a witty summary of the report’s implications (emphasis in original):

In what is reportedly the first real test of the tariff terror pass-through impact on the average American, today’s CPI print was expected to rise modestly following survey after survey suggesting the fecal matter is about to strike the rotating object… just like every mainstream media economist warned. …

So what did we get?

A nothingburger… again… as headline and core CPI both printed below expectations.

Headline CPI rose just 0.1% MoM in May (+0.2% MoM exp), inching higher to +2.4% YoY (from +2.3% YoY in April)…

Source: Bloomberg, via ZeroHedge

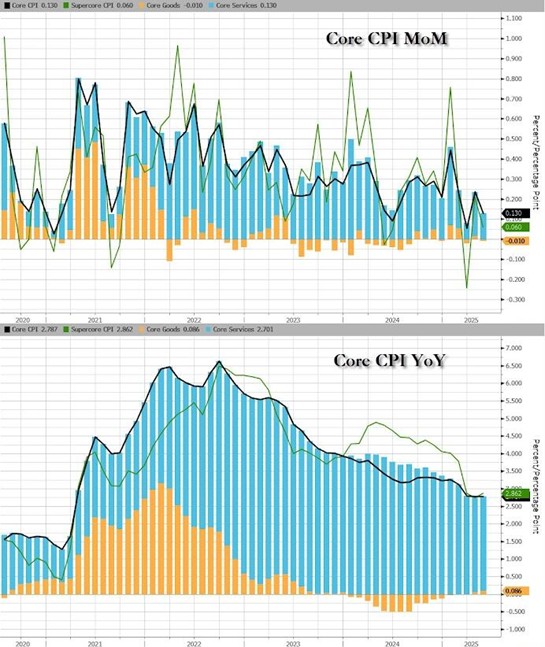

Inflation in fact slowed in May: “The index for all items less food and energy rose 0.1% in May, following a 0.2% increase in April,” ZeroHedge notes. On top of all that, “Core CPI was even more disappointing for the average PhD pundit as it rose 0.1% MoM (well below the +0.3% MoM expected), flat with April’s +2.8% YoY – the lowest since March 2021.”

Notably, all the reported inflation came from increases in prices of services, not of goods, with goods prices dropping slightly, ZeroHedge reports:

Source: Bloomberg, via ZeroHedge

The inflation decrease “defied expectations,” as the purveyors of the conventional wisdom declared. Instead of characterizing the data as defiant, an accurate description is that the analysts’ expectations were wrong.

The WSJ story presented the lack of a direct connection between tariffs and inflation as a mystery:

Among the possible explanations: Demand isn’t strong enough for businesses to push along price increases to customers, leading tariffs to be less inflationary than expected. Another theory is that because businesses loaded up on inventories ahead of anticipated tariff increases, that allows them to wait until later in the year to test the ability of consumers to accept higher prices.

“Even when we’re getting into months where we could see the tariff impact, it might be the case that demand is soft enough that we’re not seeing huge increases in prices, because you can’t really pass on as much as a business might want,” said Veronica Clark, U.S. economist at Citigroup.

A simple alternative explanation is that if the price of a good rises above the level at which people value that good, people won’t buy it. They will buy other things, or, even more shockingly contradicting the conventional wisdom, they will save and invest in private-sector production.

Still, the doomsayers’ hopes of eventually being proved right remain strong, the WSJ notes:

Jonathan Pingle, chief U.S. economist of UBS’s investment-banking division, noted that the impact of tariffs on May’s data would have been muted by a variety of factors. Beyond the fact that businesses stocked up on inventory, he noted that Trump also exempted certain shipments if they were already in transit at the time tariffs were enacted. Many goods whose prices factor into the Labor Department’s calculations are sampled only every other month.

“We’ve been assuming the bulk of increases from tariffs wouldn’t really start to show up until summer,” Pingle said. “Just because we haven’t seen it yet doesn’t mean we won’t see it eventually. This doesn’t mean we’re out of the woods yet.”

As ZeroHedge put it, “So, we guess we will just have to wait for NEXT MONTH to see the hyperinflationary hellscape that so many TV pundits told us would occur after Trump’s terror tariffs were imposed.”

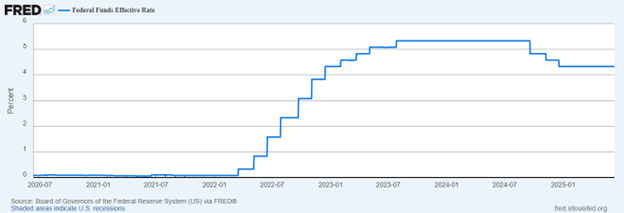

These inflation forecasts have immense effects on the economy. In line with the tariff-inflation predictions, the Fed has adhered to a tight-money policy since Trump took office, thus artificially slowing economic growth. The public suffers while the Fed slays imaginary monsters.

As the U.S. central bank, the Fed is in charge of the nation’s money supply and hence is responsible for controlling inflation. Absent Fed-induced expansion of the money supply, tariffs pushing up prices of imported goods, even of intermediate goods used in U.S. manufacturing (of which there is not very much these days), should be automatically offset by substitutions, in which both consumers and producers seek out less-expensive, appropriately priced goods (and services) or save their money. The Fed seems to have overlooked that.

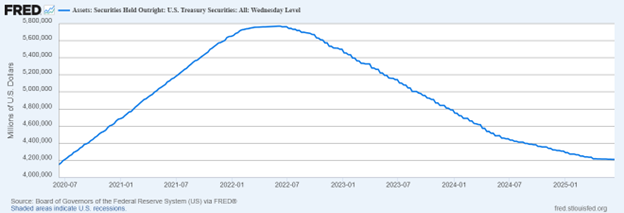

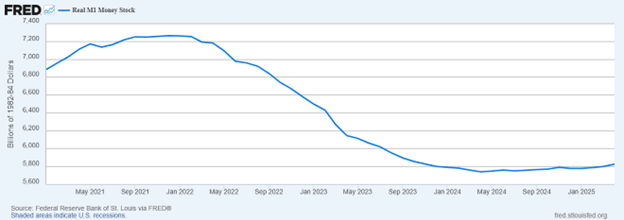

Far from expanding the money supply, the Fed’s policy in Trump’s second term has been to keep the money supply tight by holding interest rates much higher than in the first half of President Biden’s first term and to continue to sell securities, which also tightens the money supply:

A cynic might observe that the Fed reduced interest rates to stimulate the economy and help the presidential campaign of Biden’s chosen successor, Kamala Harris, and then slammed on the brakes just when Trump was about to return to office.

The inflation predictions seemed unlikely from the start, because tariffs have historically had a deflationary effect. Tariffs may be a good idea or a bad one, but inflation fears have not proven true. Importantly, the falsification of the Fed’s inflation forecast removes the central bank’s ostensible reason for its destructive current tight-money infatuation.

Sources: The Wall Street Journal; ZeroHedge

Video of the Week

Riots are once again breaking out in California, all the way to Chicago and East coast cities. The National Guard is on the streets of LA to handle violent protests against ICE, and it seems there is evidence that these multi-day protests are anything but organic. Similar protests are planned around the country this weekend, attempting to counter a military showcase parade President Trump has planned for the 250th birthday of the U.S. Army.

The media can’t be trusted to cover it fairly, which leads to our next question: is the “knowledge” economy falling apart? The mainstream news media, academia, and scientific establishment are rapidly losing credibility in the eyes of the average person, and it may be well deserved.

Turning our eyes abroad, Trump says he struck a deal with China on trade, we’ll look at the good, the bad, and the ugly — and the UK’s Labour Party recently levied taxes that resulted very quickly in a nice demonstration of the Laffer Curve, ending in less government income rather than more.

The Heartland Institute’s Linnea Lueken, Jim Lakely, Chris Talgo, and S.T. Karnick will cover all of this and more on episode Episode #498 of the In the Tank Podcast.

World Bank Backs Trump

Economists at the World Bank last week surprisingly affirmed President Donald Trump’s idea of using tariffs to reduce balance of trade disparities between the United States and other nations. The Washington Post reports:

The World Bank effectively endorsed President Donald Trump’s complaint about the high tariffs that other nations impose on American products, calling for U.S. trading partners to sharply reduce their import taxes to more closely match the lower levies typically imposed by Washington.

The president says it is unfair that American companies face higher trade barriers in Europe, Japan and China than foreign businesses confront when they sell their products in the U.S. market. The World Bank’s top economists agreed, calling for an across-the-board reduction in tariffs.

The recommendation came during a news briefing on the World Bank’s economic forecast, which concluded that the president’s multifront trade war is damaging the U.S. and global economies.

World Bank experts said the U.S. economy in 2025 will grow at an annual rate of 1.4 percent, 0.9 percentage points slower than its January forecast. That would be the weakest U.S. performance since the global financial crisis, excluding the first year of the pandemic in 2020. The forecast for China to grow at a 4.5 percent pace is unchanged.

The institution’s economists explicitly affirmed Trump’s argument for the use of tariffs, the Post story notes:

Trump’s trade war grew out of a mismatch between the tariffs imposed by the U.S. on foreign goods and the higher levies other nations applied to American products, the World Bank economists said.

“This favorable access to the U.S. market could not be sustained indefinitely,” said Indermit Gill, the World Bank’s chief economist.

Such outdated trade rules “should be updated,” Gill said.

The statements in support of Trump and current U.S. economic policy were unexpected, given that the World Bank has generally shown much more affection for socialists and Communists than for free markets. Writing at The Last Refuge, blogger “Sundance” notes that the World Bank supported Joe Biden’s grotesquely ill-advised economic plan:

This is actually a very surprising development. The World Bank (WB) is a heavily controlled multinational exploit of the World Trade Organization (WTO) and World Economic Forum assembly (WEF). This could be looked upon as the WTO/WEF taking a knee as they finally accept Godzilla Trump is not going to relent. Remember, the Build Back Better agenda was a construct from the WEF/WTO.

Noting that “President Trump’s full-frontal assault on the global trade imbalance” is intended to bring “global trade wealth back to the USA,” Sundance argues that “the World Bank is telling Europe to stop being intransigent or they will lose U.S. military support,” which the writer accurately describes as “[a] very unusual shift in WB tone.”

In an article highly critical of Trump and his economic policies, AP essentially confirmed Sundance’s observation: “The World Bank expects the 20 European countries that share the euro currency to collectively grow just 0.7% this year, down from an already lackluster 0.9% in 2024. Trump’s tariffs are expected to hurt European exports.”

The predicted EU downturn is part of an expected overall decline in the world economy, the Post reports:

The global economy will grow this year at an annual rate of 2.3 percent, 0.4 percentage points slower than the bank expected in January and nearly a full percentage point below the average of the 2010s, the bank’s experts told reporters. If trade tensions escalate with even higher U.S. tariffs and retaliation by other nations, growth could slip to an “anemic” 1.8 percent, the bank said.

While acknowledging that major nations’ barriers to U.S. trade have damaged the American economy, the World Bank appears to telling Europe, Japan, and China to agree to Trump’s demands in order to avert a worldwide economic recession, a significantly different concern. That aligns with the suggestion that concerns about tariffs should center on deflation. In any case, the institution’s admission that major nations have long imposed outsized trade barriers against the United States highlights a massive distortion in the global economy that calls for some form of redress.

Sources: The Washington Post; The Last Refuge; AP

NEW Heartland Policy Study

‘The CSDDD is the greatest threat to America’s sovereignty since the fall of the Soviet Union.’

Crypto Plan for Social Control?

The GENIUS Act stablecoin bill cleared a critical vote on Wednesday and appears to be headed toward passage in the U.S. Senate. The Hill reports:

The Senate voted Wednesday to advance legislation setting up a regulatory framework for payment stablecoins, bringing the crypto bill one step closer to a final vote in the upper chamber.

Eighteen Democrats voted with almost every Republican to end debate on an updated version of the GENIUS Act.

The new bill text was reached as part of lengthy negotiations between Republicans and crypto-friendly Democrats last month, ahead of an earlier procedural vote on the Senate floor last month.

The bill is designed to protect big corporations and financiers and strengthen the U.S. government’s control over the emerging technology, Glenn Beck and Justin Haskins argue at Beck’s website:

The GENIUS Act, short for the Guiding and Establishing National Innovation for U.S. Stablecoins Act, is being promoted as a bipartisan step toward a more stable crypto landscape. But this bill could lay the foundation for a programmable digital currency. It would not be controlled by the people and would offer few real privacy protections. Instead, power could concentrate in a handful of elite financial institutions, operating under the heavy hand of government regulation and influence.

The legislation would tie stablecoins to the U.S. government, the authors note:

The bill mandates that stablecoins be backed by cash or government debt. Treasuries pay interest; cash does not. That financial reality creates an obvious incentive for stablecoin issuers to pour funds into Treasuries, deepening the federal government’s dependency on digital finance.

What we’re left with is a digital dollar in everything but name. It would be privately issued, publicly regulated, and deeply intertwined in government fiscal strategy.

The programmability of the coins would enable the issuers, the federal government, and global institutions to exert all sorts of control over those who use them, Beck and Haskins note:

One of the most alarming features of this emerging system is programmability. Stablecoin developers would have the ability to encode conditions into the money itself. That includes restrictions on where, how, and by whom funds can be spent.

These controls wouldn’t be set by everyday users. They would be dictated by developers and institutions with global affiliations. Some of the top investors in stablecoins have already promoted the use of radical social credit scores, such as ESG. And while these institutions issuing stablecoins aren’t government officials, they often operate under regulatory pressure and in close alignment with the same bureaucratic agenda.

The legislation seems designed to create a public-private partnership to monitor and control people’s monetary transactions, Beck and Haskins write:

The GENIUS Act is not simply a measure to better regulate one part of the crypto industry. It could be the beginning of a new financial infrastructure designed to monitor, influence, and ultimately control the public.

This is how central bank digital currency might arrive in the United States. It might not come from the Federal Reserve, but through private issuers that are shaped, restrained, and quietly directed by federal regulators. These issuers are not elected. They are not accountable to you. Yet they could soon determine how your money functions.

We have been down this path before. The Digital Millennium Copyright Act of 1998 was supposed to benefit the public by protecting providers of web content, and it ended up in a conspiracy between those businesses and the federal government to censor information damaging to candidate Joe Biden in the runup to the 2020 presidential election, and much more collaboration to suppress public knowledge thereafter. If Beck and Haskins are right, the GENIUS Act may be another great, big, candy-coated poison pill.

via Townhall

Bonus Video of the Week

Hurricane season has begun, and while it’s quiet so far, what kind of year can we expect? The Heartland Institute welcomes back Stanley Goldenberg—one of America’s leading hurricane forecasters—to find out. We’ll also tackle the week’s Crazy Climate News: Greta Thunberg’s latest publicity stunt, a proposal to nuke the ocean floor for “carbon capture,” Trump pulling the plug on California’s EV mandate, and accusations that The Heartland Institute is “undermining EU climate rules.” You’re welcome.

Contact Us

The Heartland Institute

3939 North Wilke Road

Arlington Heights, IL 60004

p: 312/377-4000

f: 312/277-4122

e: [email protected]

Website: Heartland.org