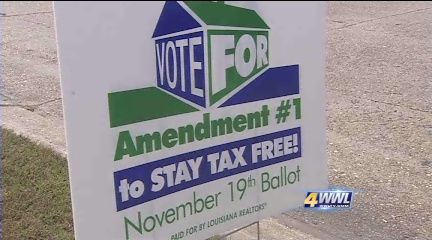

Louisiana voters have approved an amendment to the state constitution to permanently ban real estate transfer taxes in the state.

The Nov. 19 vote will not affect the transfer tax in New Orleans, which levies a $325 fee whenever a home, business, or piece of land is sold, but it will stop the Louisiana state government and local governments from establishing such a tax. New Orleans has the only real estate transfer tax in Louisiana, according to Kevin Kane, president of the New Orleans-based Pelican Institute for Public Policy, who supported the measure to ban the taxes.

In 2010, New Orleans took $3.6 million from property transactions and is expected to take another $4.4 million in 2011, according to city estimates.

“Louisiana voters oppose new taxes, plain and simple,” said Kane. “Aside from this vote, Gov. [Bobby] Jindal has consistently opposed tax hikes, and the legislature is largely opposed to tax increases. Most people believe that our government has the resources it needs and should not be creating new taxes and fees.”

Louisiana’s real estate transfer tax ban took effect Nov. 30, making it one of four states banning such conveyance taxes in their constitutions. The other three are Arizona, Missouri, and Montana.

Watchdogs Happy

Real estate and tax watchdog groups favored the constitutional amendment. Opponents included the Louisiana Budget Project, which advocates for low-income citizens in the state.

In a report for the LBP, analyst Tim Mathis wrote, “The prime support to ban the taxes comes from the Louisiana Realtors Association, which claims that transfer taxes are an onerous, regressive burden that have the potential depress home sales. But a Constitutional amendment is a ‘one-size-fits-all’ remedy that would deny local leaders the flexibility needed to cope with new budget challenges.”

Louisiana’s Livingston Parish, which operates under a home rule charter, tried to impose a real estate transfer tax of $300 per transaction in 2004. The state attorney general later issued an opinion calling the tax unconstitutional because the legislature had not delegated the new taxing authority to the parish. The parish council then dropped the tax.

The Public Affairs Research Council of Louisiana explained the attorney general’s objection as coming down to the difference between a tax and a fee. The attorney general viewed the charge as a tax needing the approval of state lawmakers for the local government to implement.

“Broadly described,” the PARC wrote, “a tax generates general revenue whereas a fee is charged to defray the specific cost of a government service or administrative expense. Under current law a local government might be able to create a fee to support a specific, related program, such as an environmental impact fee.