Last week, a coalition ostensibly made up of four groups (Let Freedom Ring, American Majority, 60 Plus, and Americans for Job Security) released a letter (PDF) urging support of the Marketplace Fairness Act. Beyond coming to a bad conclusion about the bill’s merit, the letter gets so much wrong that my reaction to it was more one of pity than of annoyance or concern that it might be effective. Let me count the ways that they totally blew it with this letter.

First of all, they didn’t write it. Or at least the properties of the document suggest that they weren’t the original authors. The metadata of the letter lists someone named “Travis Burk” as its author (go ahead, look for yourself). Some rudimentary Googling tells me that Travis Burk is a Senior Account Executive at CRC Public Relations. Though Google knows many things, one thing it cannot tell me is who Travis’ client is and why he wrote this letter on behalf of four conservative organizations.

So, what did Travis get wrong when drafting this letter? Lots of things. In fact, most of them are straight out of the “Top 10 bogus arguments for the Marketplace Fairness Act” piece that I wrote recently. I guess he thought I wrote it as a guide, not a warning.

Let’s start with the fact that he references the wrong bill number (oops). The letter urges Members of Congress to support S. 336, but the bill that recently passed the Senate was S. 743. This is because the bill’s sponsors had to drop the same bill text with a new number in order to allow them to employ a procedural trick to skip Finance Committee scrutiny and go directly to the floor without significant debate or discussion. S. 336 is dead and gone, effectively.

Mischaracterizes Supreme Court Ruling

Travis also incorrectly characterizes the Supreme Court case around which much of this debate centers. He writes that the decision in Quill v. North Dakota said that “States, without Congressional authority, cannot require online retailers to collect sales taxes at the point of sale, as they often require brick-and-mortar shops to do.” This is false on two levels.

First, even after Quill states very clearly do have the authority to require sales tax collection at the point of sale (so long as that point of sale exists within their borders) and doing so would actually be a great idea. Travis just alluded to the fact that brick-and-mortar sales effectively operate on a very simple system called origin-based sourcing, something that we’ve been advocating at R Street for some time: require tax collection based on where the business is located, not based on where the customer lives. That’s how every brick-and-mortar sale is governed today, so let’s extend that to online sales as well.

Second, that’s not at all what Quill said. The Court’s decision said that states could not require sales tax collection and remittance for businesses not physically present within their borders. This reiterated the so-called “physical nexus” standard that underpins virtually all of our tax policies. After the collapse of the Articles of Confederation, we designed a system where state taxing power ended at its borders and Quill basically affirmed that because of the huge complexity that exists in sales tax codes.

No Picking Favorites

Travis continues by stating that current policy “…is a clear case of government picking winners and losers in the economy.” Yeah, no. Current law treats every retailer, regardless of their model, identically. If they’ve got a physical presence in a state, they’ll have to collect and remit its sales tax for sales made to consumers in that state. If they don’t, they don’t. There is no “picking” of winners and losers between business models in a policy that makes no distinction between business models.

Travis goes on to trot out the tired old arguments about federalism, saying, “We may not like the choices every state makes, but that is hardly a justifiable reason for federal usurpation of their authority.” As I pointed out in the “Top 10″ piece, states don’t have “rights,” they exercise powers that are granted to them by the people in order to achieve certain common goals. A power that they don’t have now, and generally haven’t throughout the history of our Constitution, is to extend their tax authority outside their borders. There is no federalism concern in not granting states the ability to dramatically expand their authorities in unprecedented and damaging ways.

He then goes on to specifically call out other conservative organizations that have written in opposition to the bill, including us at the R Street Institute. When discussing a letter we organized (which was signed by basically every conservative group other than the four mentioned here), he writes, “Either they do not understand how the legislation works or they do not know how e-commerce works” after quoting us on the extra hoops the Marketplace Fairness Act envisions forcing online sales to jump through. Let’s just say that, in my humble opinion, I know the legislation a bit better than Travis does if this letter he drafted is any indication.

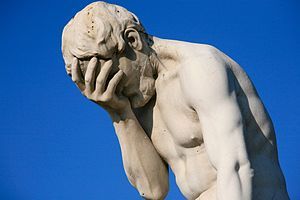

If my face looks a little redder than normal, you’ll know it’s because I’ve been facepalming all day at this profoundly misguided letter.

Andrew Moylan ([email protected]) is Outreach Director and Senior Fellow at the

R Street Institute. Used with permission of Rstreet.org.