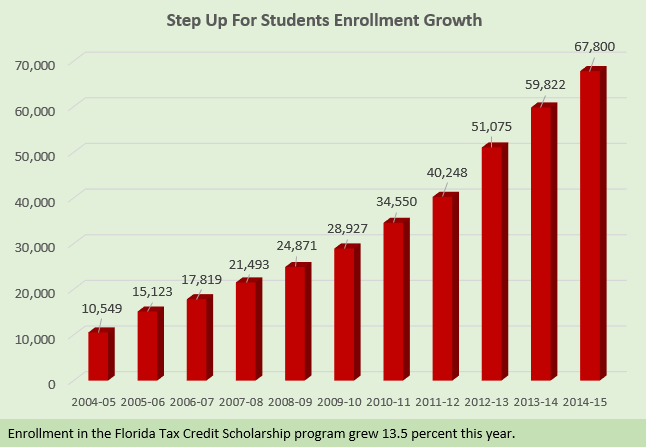

The number of low-income students served by the Florida Tax Credit Scholarship program has reached a new high, with more than 67,800 students enrolled in participating private schools this fall.

The latest numbers are another sign of growing demand for the nation’s largest private school choice program, which was created in 2001. They’re also a reminder of what’s at stake in a lawsuit the Florida School Boards Association and other groups filed Aug. 28 to end it.

The scholarships, worth $5,272 apiece this year, are limited to families who qualify for free- or reduced-price lunch, meaning family incomes below 185 percent of the federal poverty level. Partial scholarships are available for renewal students in households up to 230 percent of poverty.

This year’s preliminary data shows the average income of participating families is 5 percent above poverty. Nearly 70 percent of scholarship students are black or Hispanic.

The latest annual evaluation of test results, released last month by Northwestern University researcher David Figlio, found scholarship students are keeping pace academically with students of all income levels nationally.

Corporations get dollar-for-dollar tax credits for contributing to the scholarship program, with an annual cap on contributions set by the state legislature. The cap is $357.8 million for 2014-15 and will grow to $447.3 million for 2015-16.

Gibbons ([email protected]) is the public affairs manager at Step Up for Students.