4.8-star rating on Amazon with 45+ early reviews

Endorsed by Glenn Beck, Alex Newman, and Kevin Freeman

New Book from New York Times bestselling author Justin Haskins

Available now on Amazon in hardcover, paperback, audiobook, and e-book formats

SCHAUMBURG, IL (January 26, 2026) – Most Americans believe they own the stocks, bonds, and retirement assets in their investment accounts. Legally, they don’t. That reality carries massive implications for the security of Americans’ savings as the United States barrels toward its next major economic crisis—one that may arrive in months or years, but that few believe can be avoided for much longer.

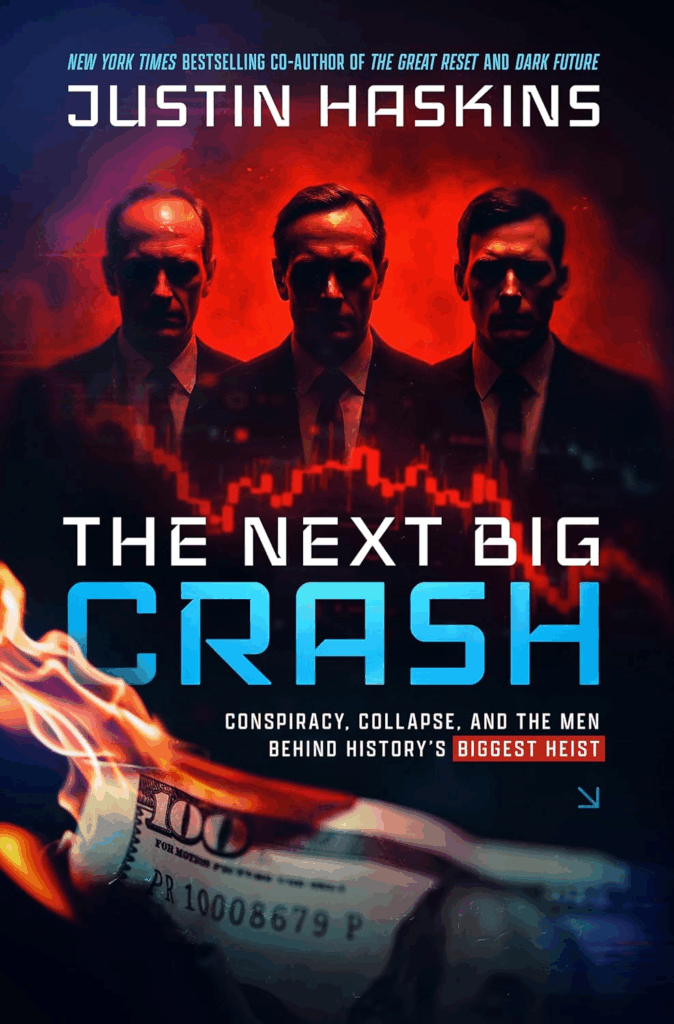

In The Next Big Crash: Conspiracy, Collapse, and the Men Behind History’s Biggest Heist, published by Our Republic in partnership with The Heartland Institute, New York Times bestselling author and Heartland Vice President Justin Haskins—along with contributing author Jack McPherrin, a senior policy analyst and research fellow at Heartland—pulls back the curtain on a little-known legal and financial system that has quietly stripped ordinary investors of true ownership over their assets.

At the core of the book is a hidden legal reality: Wall Street’s biggest players rewrote the rules of asset ownership so that nearly all U.S. securities are legally owned by a single, centralized financial entity, while investors are left with only a weak contractual claim. In a major financial crisis, investors’ assets can be frozen and seized to absorb losses at failing firms—a scenario that has already happened on a smaller scale under existing rules, and could be made far easier if emergency powers are invoked.

The Next Big Crash also traces how we ended up here in the first place. The book documents the role of key figures—including a former CIA officer with close ties to the Rockefeller family and to USAID—in building the original architecture behind today’s banks-first, investors-last system. It then shows how Wall Street pushed those changes through state legislatures across the country, where they were rubber-stamped with little to no public awareness.

The book argues that this is not a distant or theoretical problem. The legal framework that will govern the next major financial crisis is already in place, and it was explicitly designed to protect large institutions alone. Americans’ savings—and the U.S. financial system as a whole—are far more vulnerable than they’ve been led to believe. The Next Big Crash examines how these rules could play out when the next crisis hits, and outlines steps policymakers and ordinary Americans can take to avoid being left holding the bag.

The Next Big Crash was released nationwide on January 26, 2026, and is now available in hardcover, paperback, audiobook, and e-book formats.

The following statement from Justin Haskins, author of The Next Big Crash, may be used for attribution. For interview requests or additional comment, please contact Heartland Director of Communications Jim Lakely at [email protected], 312-377-4000, or 312-731-9364 (cell). Members of the media may also contact Haskins directly at [email protected].

“The biggest lie in modern finance is that investors actually own their investments. In reality, the rules were rewritten decades ago to protect Wall Street first and ensure that ordinary people bear all of the risk.

“The Next Big Crash explains how that system was built, why it’s so dangerous in a crisis, and what Americans can do now to avoid being the ones who pay the price when the system breaks.”

Justin Haskins

Vice President, Policy

The Heartland Institute

[email protected]

The Heartland Institute is a national nonprofit organization founded in 1984 that focuses on free-market solutions to social and economic problems. For more information, visit Heartland’s website or call 312-377-4000.