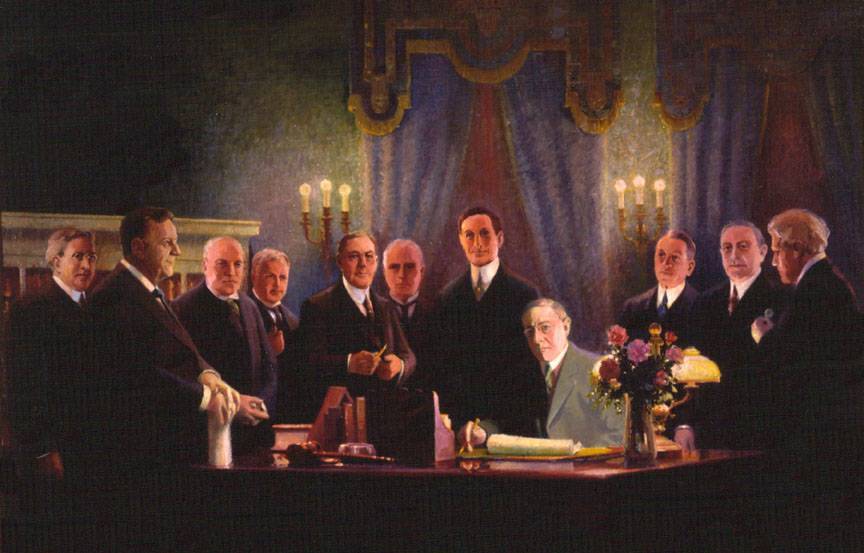

Two days before Christmas 1913, President Woodrow Wilson signed the Federal Reserve Act, creating America’s latest and current central bank, the Federal Reserve System. It’s a sobering thought that in the 100 years since the Fed’s creation, the dollar has lost 95 percent of its value. Had the Fed never been created, America would be dotted with Nickel Stores (other things being equal) instead of Dollar Stores. But that is just the beginning of the sad tale.

The Fed was not America’s first experience with banking regulations or a central bank. From the very beginning, the United States had substantial money and banking regulations at the state and national levels, even with a gold standard. There was no free market or free banking. But as the 19th century came to a close, the national banks, led by J.P. Morgan, were dissatisfied with the money and banking regime under the reigning National Banking system, and sought to regain their previous dominance. As Murray Rothbard wrote in The Case Against the Fed,

[The] banks desperately desired a Central Bank, not to place fetters on their own natural tendency to inflate, but, on the contrary, to enable them to inflate and expand together without incurring the penalties of market competition. As a lender of last resort, the Central Bank could permit and encourage them to inflate when they would ordinarily have to contract their loans in order to save themselves. In short, the real reason for the adoption of the Federal Reserve, and its promotion by the large banks, was the exact opposite of their loudly trumpeted motivations. Rather than create an institution to curb their own profits on behalf of the public interest, the banks sought a Central Bank to enhance their profits by permitting them to inflate far beyond the bounds set by free-market competition.

Cartelization — that is, the elimination of competition — was the objective, but with the public suspicious of monopoly, the bankers had to ally with Progressive intellectuals to persuade the American people that an overarching central-banking system would serve the general welfare. One newspaper announced Wilson’s signing of the Federal Reserve Act with this revealing sub-headline: “Wilson Declares It the First of Series of Constructive Acts to Aid Business.” (The alliance of big business and progressivism is documented in, among other works, Gabriel Kolko’s Railroad and Regulation and, especially, The Triumph of Conservatism.)

A Flop

How has the Fed performed over its nearly 100 years of operation? Fortunately monetary economists George A. Selgin, William D. Lastrapes, and Lawrence H. White have come up with a report card on the Fed. (“Has the Fed Been a Failure” can be found at the Cato Institute.)

Even if we don’t count the interwar period (which some economists call the new Fed’s practice round), America’s central bank is a flop. Selgin, Lastrapes, and White sum up the record this way:

As the one-hundredth anniversary of the 1913 Federal Reserve Act approaches, we assess whether the nation’s experiment with the Federal Reserve has been a success or a failure. Drawing on a wide range of recent empirical research, we find the following: (1) The Fed’s full history (1914 to present) has been characterized by more rather than fewer symptoms of monetary and macroeconomic instability than the decades leading to the Fed’s establishment. (2) While the Fed’s performance has undoubtedly improved since World War II, even its postwar performance has not clearly surpassed that of its undoubtedly flawed predecessor, the National Banking system, before World War I.

The Fed’s dual mission is to support economic growth through stable prices and to ensure maximum employment. Thus Selgin, Lastrapes, and White assess America’s central bank according to “the relative extent of pre– and post–Federal Reserve Act price-level changes, pre– and post–Federal Reserve Act output fluctuations and business recessions, and pre– and post–Federal Reserve Act financial crises.” The Fed’s performance, unsurprising to anyone familiar with the Austrian critique of central planning, has been dismal across the board. Here’s a sample of what they found.

Inflation

“[Far] from achieving long-run price stability,” the authors write, the Fed “has allowed the purchasing power of the U.S. dollar, which was hardly different on the eve of the Fed’s creation from what it had been at the time of the dollar’s establishment as the official U.S. monetary unit, to fall dramatically.”

Let that sink in. From the late 18th century to the second decade of the 20th century, the purchasing power of the dollar was essentially stable. “A consumer basket selling for $100 in 1790,” they write, “cost only slightly more, at $108, than its (admittedly very rough) equivalent in 1913.” (Of course that extra $8 bought far better products.)

“[Thereafter] the price soared, reaching $2422 in 2008…. [Most] of the decline in the dollar’s purchasing power has taken place since 1970, when the gold standard no longer placed any limits on the Fed’s powers of monetary control.”

In sum, the dollar has lost 95 percent of its purchasing power since the Fed has been in operation. What could be more damning?

Deflation

Since the Great Depression, Selgin, Lastrapes, and White note, the Fed has eliminated deflation — defined as falling prices — from the U.S. economy. Gently falling prices were a welcome feature of the late 19th century. Imagine it: Each year people’s money bought more. Real incomes rose even when nominal incomes were unchanged. Yet economists, including the Fed’s departing chairman, Ben Bernanke, generally deem deflation as something bad. But Selgin et al. note that one kind of deflation can be beneficial. Benign deflation, they write, “is driven by improvements in aggregate supply — that is, by general reductions in unit production costs — which allow more goods to be produced from any given quantity of factor and which are therefore much more likely to be quickly and fully reflected in corresponding adjustments to actual (and not just equilibrium) prices. Historically, benign deflation has been the far more common type.”

In the last quarter of the 19th century, prices fell 37 percent — 1.2 percent a year on average. Is that what the Fed saved us from? I’m not sure that gratitude is the proper response.

Recessions

It is no surprise that the pre-Fed U.S. economy — which was by no means a time of laissez faire and free banking — performed better in this regard than it did under the Fed’s command. The authors conclude,

[Although] contractions were indeed somewhat more frequent before the Fed’s establishment than after World War II (though not, it bears noting, more frequent than in the full Federal Reserve sample period), they were also almost three months shorter on average, and no more severe. Recoveries were also faster, with an average time from trough to previous peak of 7.7 months, as compared to 10.6 months. Allowing for the recent, 18-month-long contraction further strengthens these conclusions.

Longer recessions and slower recoveries are nothing to boast of. The Fed fails again.

Alas, the failing record may not be persuasive to those who think that free markets are unstable and unsuitable for consistent growth. Who would set interest rates to guide the economy? The first answer is that government policy and Fed manipulations can create the very recessions that the Fed then tries to reverse. If the politicians and their court economists would get over their hubristic belief that they are stewards of the economy, macroeconomic crises would disappear.

Besides, the Fed cannot set interest rates, not even its narrow federal-funds rate for overnight interbank loans. At most, it targets that rate by buying and selling government securities, but it doesn’t always hit its target. The idea that the Fed can even heavily influence mortgage and other interest rates ignores important facts.

First, the Fed’s operations are small compared to the huge and complex U.S. and world economies. Writes monetary economist Richard Timberlake,

Traditional economics properly teaches that many complex market forces — countless investment and savings decisions not dependent on monetary factors — are essential in determining interest rates. The Fed funds rate that Fed policy can influence through its monopoly over the quantity of money is inconsequential in shaping most short-term and long-term rates in capital markets, unless that moneymaking power subsequently promotes a pervasive price inflation. [Emphasis added.]

Second, these days the Fed can’t lower interest rates through monetary inflation beyond the very short run. Why not? Because lenders will quickly get wind of it and respond by raising their rates to avoid being harmed by price inflation. The higher interest rates will include an inflation premium, nullifying the attempt to lower rates. (The Fed can and does create money without igniting price and interest-rate inflation. How? By effectively borrowing back the newly created money from the banks at interest. Since the Fed currently pays the banks interest on their reserves, they find it worthwhile to leave the money in their Fed accounts.)

Regarding the ineffectiveness of inflation at lowering interest rates in the longer term, monetary economist Jeffrey Rogers Hummel adds,

Globalization, with the corresponding relaxation of exchange controls in all major countries, allows [investors] easily to flee to foreign currencies, with the result that changes in central-bank policy are almost immediately priced by exchange rates and interest rates. Add to this the ability to purchase from many governments securities that are indexed to inflation, and it becomes highly unlikely investors will be caught off guard by anything less than sudden, catastrophic hyperinflation (defined as more than 50% per month) — and maybe even not then.

A New Role

Note that inflation is not nearly the threat it once was because the benefits to the politicians in terms of seigniorage and debt monetization are small. (For more, see Hummel’s “Government’s Diminishing Benefits from Inflation” at http://bit.ly/HksyiU.) But that does not mean the Fed is harmless. On the contrary, since the financial crisis of 2008, the Fed has taken on a new role: allocator of capital to particular firms and sectors. “Bernanke has so expanded the Fed’s discretionary actions beyond merely controlling the money stock that it has become a gigantic, financial central planner,” Hummel writes.

Bernanke’s targeted and sterilized bailouts have altered the fundamental nature of the Federal Reserve. . . . Bernanke has added to the Fed’s traditional function of simply manipulating the money supply and letting the market determine where the credit will flow, the function of centrally allocating credit, much of which it has borrowed. . . . [The] Fed that emerged from the [housing and financial] crisis is no longer the same as the Fed before the crisis. . . . Most economists appear not to appreciate fully how drastic the changes are that Bernanke has wrought.

Hummel concludes, “Helicopter Ben talks a good line about being ready to unleash quantitative easing, but this talk only imparts an aura of justification for the Fed’s incredibly expanded role in allocating the country’s scarce supply of savings. If anything, his policies were closer to a quantitative tightening. A better moniker would therefore be ‘Bailout Ben.'”

With the Fed’s turning from price inflation to capital allocation, Hummel fears that inflation hawks are fighting the last war. As the Fed embarks on its second century, it poses a new kind of danger, that of central planner.

Money was not invented by government. It was the spontaneous creation of people trying to ease exchange by overcoming the inconvenience of barter in the marketplace. Central banks like the Fed only messed money up, robbing the people of their purchasing power while facilitating warfare and welfare spending through irresponsible large-scale government borrowing.

Thus the Fed should not be allowed to see a new century. It should be deleted.

Sheldon Richman ([email protected]) is vice president of The Future of Freedom Foundation and editor of FFF’s monthly journal, Future of Freedom, where this article first appeared.