State and local governments in Illinois collectively owe more than $200 billion in retirement benefits for government workers, according to a report by the Illinois Policy Institute.

Illinois has long drawn attention for its huge unfunded pension liability, currently pegged by state officials at $83 billion. But that figure is only one part of the total government debt for which Illinois taxpayers are liable, according to “$203 Billion and Counting: Total debt for state and local retirement benefits in Illinois.”

The Institute describes it as the first report to put a number to both the state and local retirement liabilities, including pensions, retiree health insurance, and pension and benefit bonds.

$41,000 Per Household

“State taxpayers are local taxpayers. And Illinois taxpayers aren’t on the hook for ‘just’ the $83 billion that the state owes; they’re also facing pension shortfalls borne by local government. The true cost of Illinois’ pension and benefit crisis is $203 billion, or roughly $41,000 per household,” said Ted Dabrowski, vice president of policy at the Illinois Policy Institute. “Any reform plan being talked about must address this full burden or taxpayers will continue to be saddled with debt.”

The $83 billion the state government owes to its pension funds is only one of the six types of debt for which Illinois taxpayers are on the hook. This figure does not include bonds issued to tide over the pension funds or the additional debt taken on to provide retired government workers with generous health insurance. It further ignores all types of local debt.

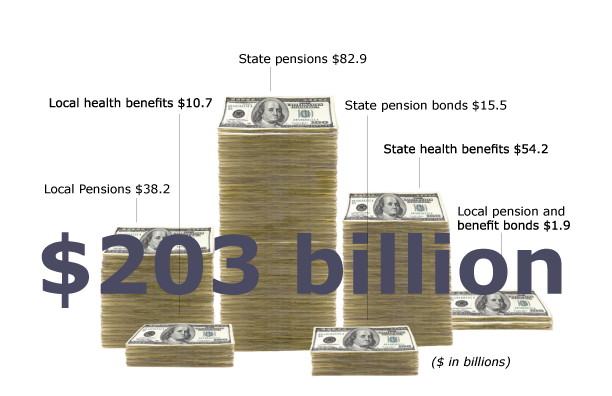

The full state government debt totals $152.6 billion: state pensions ($82.9 billion); state pension bonds ($15.5 billion); state retiree health benefits ($54.2 billion).

Local debt totals $50.8 billion: local pensions ($38.2 billion); local pension benefit bonds ($1.9 billion); and local retiree health benefits ($10.7 billion).

Three Big Steps

The Institute’s report identifies three crucial steps that would lower the retirement debts of state and local governments:

- Offer more affordable retirement compensation for future work. Future retirement savings should be contributed to an employee-managed savings account, similar to 401(k) plans used in the private sector.

- Reduce cost-of-living (COLA) increases for all retirees. Lawmakers have already changed COLAs for future employees. “Tier 2” retirees will receive a COLA equal to one-half of inflation, rather than the 3 percent compounded COLA that “Tier 1” retirees receive. Lawmakers should do the same for all state and local retirees.

- Require government retirees to cover a majority of their health insurance premiums. State and local governments should require retirees to pay most of their health insurance costs, just as government retirees in other states do. The state should also give local governments more flexibility in designing health benefits for retired workers.

Additional Step for State

The report also identifies an additional step the state government can take to dramatically reduce its pension costs: Stop paying the retirement costs of other governments.

The state should stop paying the retirement costs for state universities, community colleges and suburban and downstate school districts. This would save more than $1.1 billion in pension costs and millions more in retiree health benefits every year, and bring accountability to local governments.

The Institute’s Dabrowski said the only way to rescue the finances of state and local governments is to dramatically reform the structure, incentives and accountability within government retirement systems.

“If lawmakers and local officials act swiftly, it is possible to maintain a fair and generous system of benefits for government retirees. If they fail to act, the retirement systems could become insolvent,” he said. “The longer Illinois waits to reform its $203 billion retirement debt, the more likely the government will fail to meet its obligations to retirees.”

Collin Hitt ([email protected]) is senior director of government affairs at the Illinois Policy Institute.

Internet Info

“$203 Billion and Counting: Total debt for state and local retirement benefits in Illinois,” Illinois Policy Institute: http://www.illinoispolicy.org/blog/blog.asp?articlesource=4903