The Obama administration’s efforts to promote renewable energy took an unexpected turn in May when it was revealed a major recipient of Washington’s largesse had turned on the hand that had been feeding it and sued the federal government, claiming it had not received all the money to which it was entitled.

Changes in Subsidy Rules

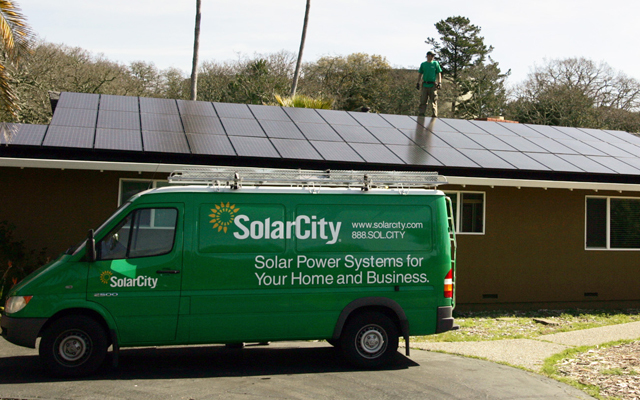

In February, San Mateo, Calif.-based SolarCity quietly brought suit in the U.S. Court of Federal Claims, saying the U.S. Treasury Department had retroactively changed the rules for a program that oversees taxpayer-funded grants to solar installation companies.

The grants in question were tucked into the giant 2009 Obama stimulus package. Known as the “Payments-in-Lieu-of-Tax Credits” provision of that law, the program provides grants to companies installing solar panels in homes and businesses. Instead of more traditional tax credits, the program provided hard cash to solar equipment installers. The amount of grant money a company was eligible to apply for depended on the fair-market value of the systems to be installed.

SolarCity contends Congress did not authorize the Treasury Department to change the rules embedded in the preexisting federal tax code. The company claims the Treasury Department undervalued SolarCity’s installation projects, thereby reducing the amount of money the firm could apply for in the future.

Overstating Fair Market Value?

The lawsuit is but the latest skirmish between SolarCity and the Treasury Department. Last December, about the time of SolarCity’s Initial Public Offering (IPO), the Treasury Department’s Inspector General (IG) launched an investigation, which is still underway, of the three largest solar panel installation and leasing companies, including SolarCity, to see if they had accurately measured the value of their projects.

At issue in the IG’s probe is the 30 percent federal tax credit for solar power based on the installed cost of the system. The 30 percent tax credit is separate from the Obama stimulus package’s grants program, but what both have in common is determining “fair-market value” as opposed to the actual cost of installation. The Treasury Department is investigating whether SolarCity and other solar equipment installers are making inflated fair-market-value claims.

Unique Business Model

Unlike Solyndra, Evergreen, and many other now-bankrupt U.S. and European solar energy companies, SolarCity never got into the business of designing and manufacturing solar panels.

Instead, SolarCity is a vertically integrated leasing and financing company. Buoyed by generous federal tax credits for renewable energy, the company installs solar panels on customers’ roofs for free and then sells them the electricity for the next 20 years. SolarCity retains ownership of the installed equipment, which is leased to the home or business owner.

Needs Government’s Help

Founded in 2006, the company currently operates in 14 “sun-rich” states, including California, Arizona, Nevada, and Colorado. Its future will depend in no small part on whether the current federal subsidies for renewable energy, scheduled to expire in 2017, will be extended well beyond that date.

“SolarCity has an innovative business model, but it nevertheless appears to be reliant on subsidies, said Daniel Simmons, director of state policy at the Institute for Energy Research. “Companies that are dependent on subsidies are always subject to the changing tides of political opinion and politically generated payments.

“Whether SolarCity survives depends on how long the subsidies last, because solar power is one of the most expensive sources of electricity. Without government’s helping hand, the company will have a hard time competing in the energy market,” Simmons explained.

Bonner R. Cohen, Ph. D. ([email protected]), is a senior fellow at the National Center for Public Policy Research.