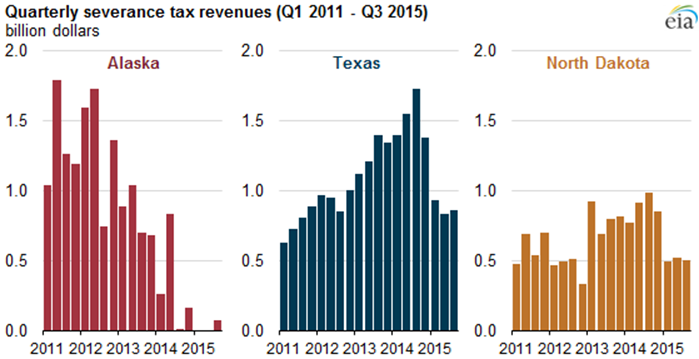

The Department of Energy announced state revenue from severance taxes dropped as the price of crude oil falls below $30 per bushel. The following charts show tax revenue for 6 states.

Source: Department of Commerce, U.S. Census Bureau, Quarterly Summary of

Source: Department of Commerce, U.S. Census Bureau, Quarterly Summary of State and Local Taxes

Note: In Wyoming, revenue collections are due in February, and third quarter payments not required.

Fossil fuels of coal, oil, and natural gas pay severance taxes to state and federal governments. Income taxes to local, state, and federal governments and applicable property taxes. Annual revenues are tens of billions.

With all the promotion of renewable energy sources of solar, wind, ethanol from corn, and other biofuels; it is important to reflect do these sources pay severance taxes? Or for that matter do they pay any taxes? The answer is a resounding no. Fossil fuels are not a drain on taxpayers. Renewable energy sources are a great drain on taxpayers due to subsidies for their production, lack of tax revenue from their products, and loss of fossil fuel tax revenue from fossil fuels they replace.

The policy of the Obama Administration of replacing a valuable commodity of fossil fuels that creates wealth with renewable energy sources that consumes wealth may be the reason for the economic malaise befalling the United States the past half dozen years. Total losses may be hundreds of billions annually.