Publications

-

Research & Commentary: Arkansas E-Cigarette Tax Is Disservice to Tobacco Harm Reduction

Publication -Research and Commentaries -Proposal to add a 68 percent tax to vaping products is a disservice to tobacco harm reduction. -

Research & Commentary: Utah’s Proposed E-Cigarette Tax Will Snuff Out Harm Reduction

Publication -Research and Commentaries -Less than 10 percent of revenue generated by tax will go toward tobacco prevention and education. -

Research & Commentary: Regressive Tax in New Mexico Will Punish Low Income Tobacco Users and Threatens Harm Reduction

Publication -Research and Commentaries -Proposed increase in the excise tax on cigarettes and other tobacco products is regressive, fosters black markets and negatively impacts the public health gains tobacco harm reduction products provide. -

Research & Commentary: Renewables Portfolio Standard Expansion Would Disproportionally Harm Low-Income New Mexicans

Publication -Research and Commentaries -State Utilities Would Be Forced To Generate 80 Percent Of Electricity From Renewable Sources By 2045 -

Research & Commentary: Keep the Income Tax out of Wyoming

Publication -Research and Commentaries -In this Research & Commentary, Matthew Glans examines two new proposals in Wyoming that would create new income taxes in the state for the first time. -

Research & Commentary: Efforts to Repeal Education Tax Credit Program Punish Low-Income New Hampshire Children

Publication -Research and Commentaries -Program Is Open To 34 Percent Of New Hampshire Students -

Research & Commentary: Tennessee Should Rollback or Repeal Certificate of Need Laws

Publication -Research and Commentaries -In this Research & Commentary, Matthew Glans examines several new proposals in Tennessee that would roll back or fully repeal the state's certificate of need laws. -

Research & Commentary: Renewable Energy Mandate Expansion, Regressive Carbon-Dioxide Tax Would Make Life Harder for Low-Income Bay Staters

Publication -Research and Commentaries -Proposals Would Set Up A 100 Percent Renewable Energy Mandate & A $20 Per Ton Carbon-Dioxide Tax -

FAQ: Education Choice in West Virginia

Publication -Policy Tip Sheets -In this FAQ, Lennie Jarratt answers the most frequently asked questions about education in West Virginia. -

Research & Commentary: Regressive Carbon-Dioxide Tax Proposals Are Bad News for Hawaii Families and Businesses

Publication -Research and Commentaries -Multiple Proposals Introduced Ranging From $6.25 Per Ton To $55 Per Ton -

Research & Commentary: Regressive Carbon-Dioxide Tax Would Be Harmful to Montana Residents and Businesses

Publication -Research and Commentaries -Tax Would Begin At $10 Per Ton, Increase by $1 Per Ton Each Year -

Research & Commentary: Randomized Trial Finds E-Cigarettes Are More Effective Smoking Cessation Tool than Nicotine Replacement Therapy

Publication -Research and Commentaries -New study finds electronic cigarettes and vaping devices to be "twice as effective as nicotine replacement at helping smokers quit." -

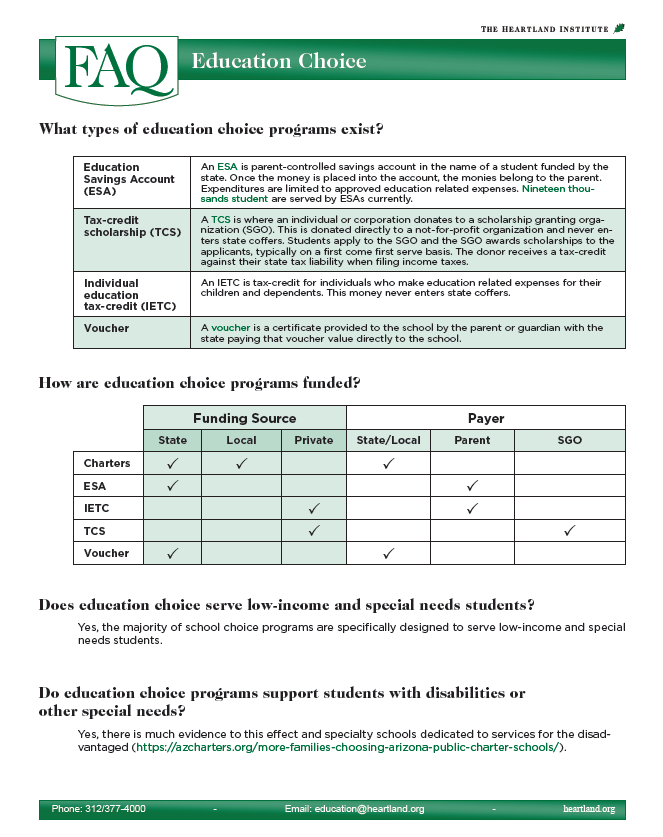

FAQ: Education Choice

Publication -Policy Tip Sheets -In this FAQ, Lennie Jarratt answers the most frequently asked questions about education choice. -

Research & Commentary: Maine Should Hold Its Ground on the Tip Credit

Publication -Research and Commentaries -In this Research & Commentary, Matthew Glans examines a new bill in Maine that would for the second time in two years eliminate the tip credit for tipped workers. -

The Leaflet: The Road to Prosperity Is Paved With Free-Market Policies

Publication -The Leaflet -States with tax-and-spend policies continually fall at the bottom of economic outlook and performance rankings. -

Research & Commentary: Strike Vouchers Would Keep Denver Students in the Classroom

Publication -Research and Commentaries -Strike Vouchers Make Sure As Many Children As Possible Are Freed From Outside Forces Controlling Their Education -

Research & Commentary: West Virginia Should Dedicate At Least Some Tobacco Funding to Cessation Efforts – Rather Than Restrict Adults Access to Tobacco Products

Publication -Research and Commentaries -West Virginia spent $0 from tobacco settlement payments and taxes in 2018 to fund cessation efforts, rather than restrict access to adults, lawmaker should reform how they currently spend tobacco revenues. -

Research & Commentary: Opening Wisconsin to Dental Therapy Would Help Dental Shortage

Publication -Research and Commentaries -In this Research & Commentary, Matthew Glans examines Wisconsin's dental health care shortage and how mid level providers like dental therapists could help fill this gap. -

Research & Commentary: Tax-Credit Scholarship Program Would Benefit Low-Income and Disabled Kentucky Students

Publication -Research and Commentaries -Tax-Credit Scholarship Programs Are The Most Popular Form Of Private School Choice In The Country -

Research & Commentary: Getting Ex-Offenders Back to Work in Mississippi

Publication -Research and Commentaries -In this Research & Commentary, Matthew Glans examines several criminal justice reforms in Mississippi that would help ex-offenders reenter society and the workforce. -

Research & Commentary: Many Paths for Tax Conformity are Available for Arizona

Publication -Research and Commentaries -In this Research & Commentary, Matthew Glans discusses the debate over tax conformity in Arizona and how the state can and should proceed with conforming state tax laws to the new federal tax changes. -

Research & Commentary: Renewable Energy Mandate Expansion, Carbon-Dioxide Tax Would Make Life Harder for Low-Income Washingtonians

Publication -Research and Commentaries -Proposals Would Set Up A 100 Percent Renewable Energy Mandate & A $15 Per Ton Carbon-Dioxide Tax -

Testimony before the Illinois Senate Public Health Committee

Publication -Testimony -Testimony before the Illinois Senate Public Health Committee regarding a proposal to increase the age to purchase and possess tobacco and vaping products. -

Research & Commentary: Vermont’s Draconian Tax Will Snuff Out Tobacco Harm Reduction

Publication -Research and Commentaries -A 92 percent wholesale tax on electronic cigarettes and vaping devices will greatly hurt tobacco harm reduction efforts in Vermont.