Editor’s Note: This is Part 1 of a two-part series on how mistaken assumptions by top U.S. policymakers have worsened the financial crisis.

It has been three years since the worst financial collapse in modern history. While much has been written about events surrounding the crisis, there is a deep sense of unease over what happened and why.

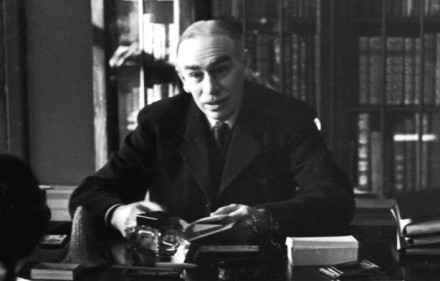

Key policymakers dealt with the crisis through the application of the economic theory of John Maynard Keynes, from the early decades of the twentieth century. Understanding why the theory failed is crucial to avoid repeating the mistakes that produced such painful consequences.

Former U.S. Treasury Secretary Hank Paulson’s book On the Brink (Business Plus, Grand Central Publishing, 2010) provides a firsthand account of how and why policymakers responded as they did at each stage of the developing crisis.

Paulson’s conclusion is shared by many. He believes his decisions, along with those of Fed Chairman Bernanke and Tim Geithner (then president of the New York Federal Reserve), saved the economy and the financial system from another Great Depression.

Series of Policy Mistakes

An alternative interpretation is the financial crisis resulted from a series of policy mistakes by each of these policymakers. A close look at the events and policy decisions during this period reinforces the alternative explanation. As the financial situation deteriorated in response to each policy mistake, the key players appeared oblivious to why things kept getting worse.

For example, Paulson’s book notes on October 9, 2008, after successive policy moves failed to contain the damage, White House Chief of Staff Joshua Bolten raised an important question: “I just wonder, Hank, why after all the steps we’ve taken to stabilize the market, are the markets not responding?”

Paulson’s response: “Josh, I wonder exactly the same thing” (Paulson, p. 346).

Alternative Perspective Ignored

The reason financial markets failed to respond as these policymakers expected is their decisions were based on a flawed economic theory. Each of the key U.S. players—Paulson, Bernanke, Geithner, and President George W. Bush—views the economy from a Keynesian economic perspective. All were educated at Ivy League schools (mainly Harvard). All were instructed in Keynesian economic theory. None of these key policymakers appears to have been aware of an alternative, classical economic perspective, which provides a different interpretation of economic events and how to deal with them.

Keynesian theory assumes when government increases its spending or provides credit to various entities, it adds to the total amount of spending or credit. The alternative classical economic theory assumes government spending and loans come at the expense of private spending and credit. From the classical perspective, a government move to boost spending or credit to one area of the economy weakens another area.

A second distinction between the two competing theories concerns monetary policy. The Keynesian view emphasizes the importance of interest rates as a guide to the amount of money or liquidity in the economy. The classical view downplays interest rates and focuses instead on the amount of money and liquidity in the banking system.

A final distinction between the two theories relates to the role of confidence. The Keynesian view assumes confidence plays a leading role in determining the economy’s performance. Classical economic theory, by contrast, views confidence as a consequence of economic conditions. Constructive policies improve those conditions and boost confidence; destructive policies make conditions worse and undermine confidence.

Policymakers consistently relied on a Keynesian perspective to formulate economic policies to deal with the financial crisis. In so doing, they contributed to the financial crisis.

Gathering Economic Storm

Some background on events leading up to 2008 is important to understand key policy decisions surrounding the crisis. In 2001-2005 the Federal Reserve had adopted a highly expansive monetary policy. One key measure of money is bank reserves, which represent the raw ingredients of the money supply. (All references to bank reserves in this article refer to the St. Louis Federal Reserve series on adjusted bank reserves less excess reserves.)

Bank reserves are the first step in the Fed’s money-creating process. They are the one measure of money completely under the control of the Federal Reserve. When the Fed creates bank reserves, the banking system transmits the newly created reserves into more spending. When banking institutions are increasing their leverage, the pace of spending tends to increase at a faster rate than the increase in reserves. When leverage in the banking system is contracting, spending tends to increase at a slower pace than the increase in reserves.

In 2001-2005 the Fed increased bank reserves at a 5 percent annual rate. Typical lags combined with an increase in leverage in the banking system combined to produce a 6 percent to 7 percent yearly increase in current dollar spending (GDP) in 2002-2006. The increase in bank reserves provided the liquidity for a speculative boom in housing and institutional leveraging for the boom that preceded the financial collapse.

The Federal Reserve first began responding to this excessive stimulus in mid-2004 when it began raising its target interest rate from 1 percent. By the end of 2005, its target interest rate was increased to 4 percent. This fourfold increase in the Fed’s targeted interest rate was sufficient to rein in the creation of new reserves. During 2005 bank reserves were essentially unchanged.

Spending Slowdown, Reduced Reserves

The lack of growth in bank reserves led to a slowdown in spending beginning in the spring of 2006. By the end of 2006, the pace of current dollar spending had slowed to 5 percent. In spite of the slowdown, the Fed continued to increase its target interest rate. The rate hit a peak of 5¼ percent in late 2006. This increase reduced the amount of bank reserves in both 2006 and 2007. By the end of 2007 bank reserves were 3 percent less than they were in 2005. From a classical perspective, the Fed had shifted to a restrictive policy.

In late 2007 the spending pace continued to slow. In response to the slowdown, the Fed began to reduce the Fed funds rate. By the summer of 2008, the Fed’s target interest rate was down to 2 percent. From the Keynesian perspective, the decline in its targeted interest rate was consistent with an expansive monetary policy. From a classical perspective, however, this monetary policy was highly restrictive because the decline in interest rates failed to increase bank reserves. When economic conditions change rapidly, interest rates can be a poor guide to monetary policy.

In the summer of 2008, bank reserves remained 3 percent lower than the level that existed three and one-half years earlier. This lower level of bank reserves was consistent with a further slowdown, perhaps even a decline in current dollar spending. By the spring of 2009, year-over-year current dollar spending had fallen by 3 percent. A highly unusual multiyear decline in bank reserves was followed by the first year-over-year decline in current dollar spending in over half a century.

Critical Policy Decisions

Paulson’s discussion of the deterioration in the U.S. economy in 2007 and 2008 is instructive. Throughout he shows policymakers never considered the slowdown in spending and developing lack of liquidity might be related to Fed policy.

In a speech he delivered in April 2007, Paulson told audiences the subprime mortgage problems were “largely contained” (Paulson, p. 66). Bernanke made similar comments in July 2007. Paulson admits he and Bernanke were wrong. He says their problem was “We missed the dreadful quality of the most recent mortgages…” (Paulson, p. 66).

However, Paulson also notes, “We were in the midst of a general credit bubble. Banks and investment banks were financing record-size leveraged buyouts on increasingly more lenient terms” (Paulson, p. 69). Paulson clearly recognized the real problem extended far beyond the housing market.

Confusion over the role of monetary policy continued throughout this period. Paulson relates how in mid-November 2007 the Fed pumped $47 billion in temporary reserves into the banking system, “its biggest injection since 9/11” (Paulson, p. 83). The next month the Fed lowered its targeted interest rate to 4¼ percent, a full percentage point below where it had been only three months earlier.

In spite of what was widely thought to be an expansive monetary policy, data on bank reserves reveal a different outcome. In November 2007, reserves increased by only $2 billion. In December they declined by $4 billion. This pattern occurs throughout Bernanke’s tenure. The Fed announces major changes in monetary policy involving tens or even hundreds of billions of dollars in purchases or loans. Fed data then show changes in bank reserves that are often unrelated to the Fed’s announced policy.

Meanwhile, Paulson and Bernanke dealt with the developing crisis by addressing specific individual problems. As the Fed was removing reserves from the economy in December 2007, it announced a new program—Term Auction Facility (TAF)—designed to lend funds to depository institutions (Paulson, p. 84). This was a prelude to numerous attempts by both the Bush and Obama administrations and the Fed to solve problems related to a specific company or industry. While policymakers were focusing on solving these specific problems, the Fed was removing reserves and contributing to a shortage of liquidity in the overall economy.

Wrong Call on Confidence

By January 2008 it became evident the economy was getting worse. Instead of looking for the reason liquidity was drying up, Paulson and Bernanke perceived the problem as a lack of confidence. In an attempt to boost consumer confidence, Paulson recommended a $150 billion “stimulus” program including onetime tax rebates and tax breaks to encourage business investment. The idea was to put money in people’s hands so they would spend it.

Keynesian economic theory assumes when government provides people with more money, it raises their confidence and has a multiple effect that boosts spending throughout the economy. Classical economic theory, by contrast, assumes government spending creates no increase in demand. Instead, government borrowing to fund the spending reduces the amount of credit available to others. The reduction in available credit reduces spending in other areas. This offsets the increase in demand created by government spending.

During the spring of 2008, as consumers received and spent their tax rebates, there was a brief increase in demand. Current dollar GDP, a measure of overall demand, increased by 1 percent in the spring quarter. This compares to no increase in both the preceding and subsequent quarters and is generally consistent with normal quarterly fluctuations. If it did anything, then, the tax rebate merely shifted demand from one quarter into another.

From a classical perspective, demand is primarily dictated by Fed policy. Any temporary boost created by government spending will be offset by the reduction in credit caused by the increase in government borrowing. The overall impact of such fiscal manipulation is positive only if the benefits of the government’s spending outweigh the costs to those who are denied credit due to the government’s borrowing.

Since the market tends to allocate credit to its most efficient uses, policymakers’ decisions to reallocate it to other areas will tend to weaken the economy, not strengthen it. The weakness in the economy throughout the spring and summer of 2008 is consistent with this classical view.