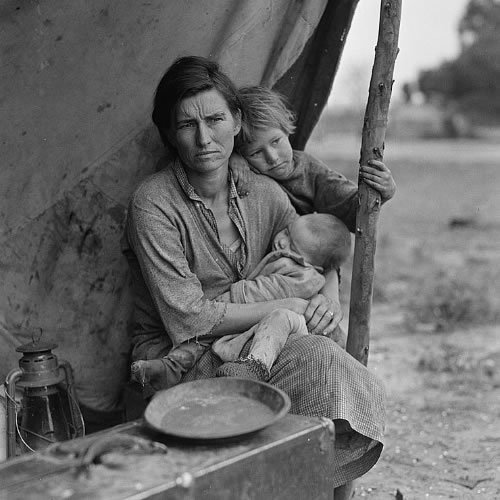

The continuing economic slump is taking a toll on Americans’ psyche, with many persons feeling flat broke, according to a new survey by online lender CashNetUSA.com.

Approximately one in four persons in the United States considers himself poor. Sixty-nine percent believe they are not poor, and 6 percent are still trying to decide or not willing to admit it, the survey concludes.

Shortly after the CashNetUSA.com poll results were announced came news household incomes have sunk to 1995 levels.

The Census Bureau reported annual household income fell in 2011 for the fourth straight year, with inflation-adjusted household income at $50,054.

Down Nearly 9 Percent

The median U,S, household income—the amount at which half the households are above and half below—is nearly 9 percent below its all-time high of $54,932 in 1999, according to the Census Bureau.

However, the figures do not include benefits such as the Earned Income Tax Credit and food stamps, which supplement the incomes of millions of families.

“The report shows that while we have made progress digging our way out of the worst economic crisis since the Great Deptression, too many families are still struggling,” said a White House spokesman in a statement.

The report “confirms that the American Dream remains out of reach for too many families,” Romney spokeswoman Andrea Saul said in a statement. “While this may be the best President Obama can do, it’s not the best America can do. Mitt Romney’s pro-growth agenda will revive our economy, spur job creation, lift families out of poverty, and create a better future for our country.”

Lower Poverty Rate

Falling household income notwithstanding, the Census Bureau reported the nation experienced a slight decline in the poverty rate in 2011 and an uptick in the number of Americans covered by health insurance, going from 83.7 percent to 84.3 percent of the population.

Acting Commerce Secretary Rebecca Blank said in a statement, “First, inflation increased 3.1 percent in 2011, more than erasing the 1.6 percent increase in nominal median household income. Inflation in 2011 was boosted significantly by spikes in energy prices. Also, median household incomes have been, and will continue to be, pulled down as the baby boom ages into the retirement years.”

“Americans are living in economic pain which is impacting their credit scores and ability to access credit to manage their expenses,” said Keith Weinberger, director of marketing and new initiatives of CashNetUSA.com, the country’s leading online licensed lender of cash advances. “The survey found that those in financial trouble have a good handle on their monthly balances and know when they need help.”

North Central Region Gloomiest

Individuals living in the North Central region of the United States feel more affected, with 32 percent considering themselves poor, according to the CashNetUSA.com survey, followed by the South (25 percent), West (23 percent), and 20 percent of those in the Northeast region.

Recession depression is most evident among younger Americans. Almost one-third of survey participants under age 30 consider themselves poor, contrasted with 14 percent of those ages 50 to 59.

Despite being down in the dumps over their financial slump, most Americans seem to have good knowledge of their available funds and monthly expenses. Almost half know the exact amount in their checking or savings account, and 48 percent have a rough idea.

Budget Followers

When asked if they know the total amount of money they spend on bills each month, 36 percent of Americans say they know the “exact amount” and 58 percent have a “rough idea.” Only 6 percent have “no idea.” Men and women were almost identical in their answers.

A higher percentage of Americans (48 percent) say they loosely follow a monthly budget while 25 percent of the individuals surveyed strictly adhere to it. One quarter (27 percent) have no budget.

The presence of children in the home, the geographic region in which they live, and even age have little impact on individuals following a budget. Income level is what matters. Thirty-six percent of individuals earning less than $30,000 annually strictly follow a budget versus just 18 percent of those making $75,000 or more annually.